Foreword

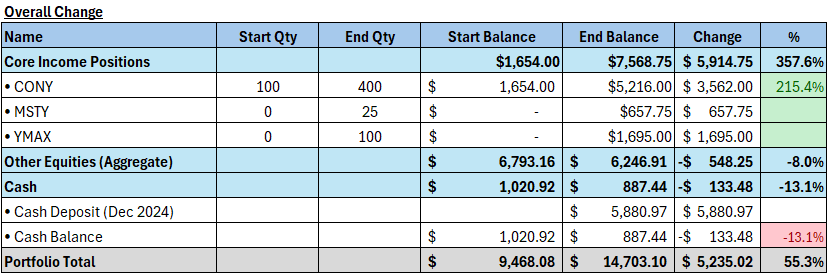

In December we shifted to expansion mode. Not only were we continuing to build our CONY stake, we were also building our YMAX and MSTY positions. Despite a modest end of year pullback, our income strategies continue pulling through, laying the groundwork for January.

Month 3 Objective Review

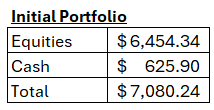

- Deploy $7,000 across core ETFs

- $7,162.17 deployed (~102% of Target)

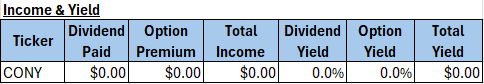

- Income target of $200 in dividends and option premiums

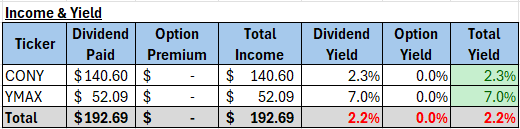

- Combined net dividend and option premium Income of $192.69 (~96% of Target)

- Maintain 10 – 12 % of portfolio in cash for assignments, and tactical dip buys.

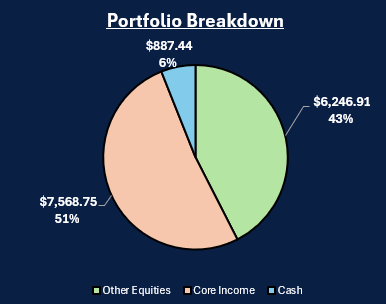

- $887.44 in cash at month end (~6% of portfolio)

We marginally overshot our ETF buys and nearly hit our income target. Our cash runway however is thinner than ideal for assignments or opportunistic buys.

Deposits

- Total Cash Deposit – $5,880.97

Market Update

- The S&P 500 fell -2.6% in Dec 2024, weighted down by year-end-tax-loss selling and profit taking.

- Federal Reserve held rates at 4.50 – 4.75% signaling a pause after November cut.

- BTC closed at $93,429 down -3.1% reversing part of November’s rally.

- The CBOE Volatility Index closed at 17.35, the second highest monthly finish of 2024.

- Year-End fund balancing and holiday thinned liquidity which amplified swings.

A modest pullback tested NAV resiliency, but the dip created entry points for our income ETFs. Elevated volatility, especially in crypto, continued to support option premiums on MSTY. Meanwhile, Federal Reserve pause conditions sustained dividend sensitive ETFs like CONY and YMAX.

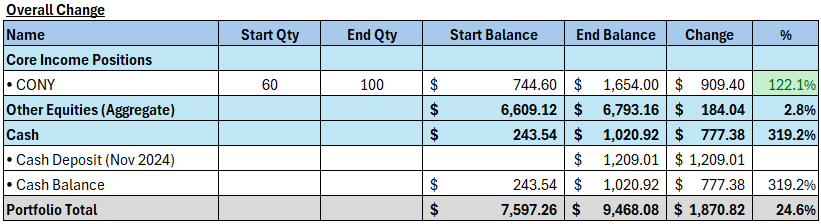

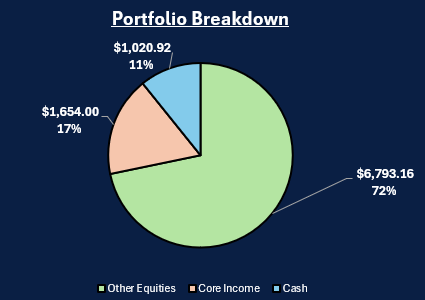

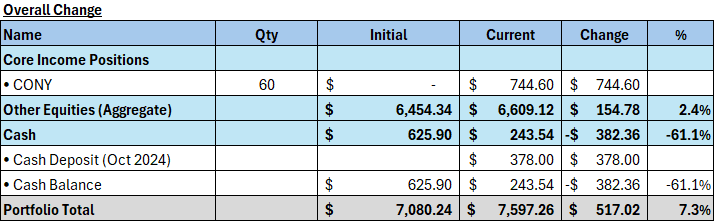

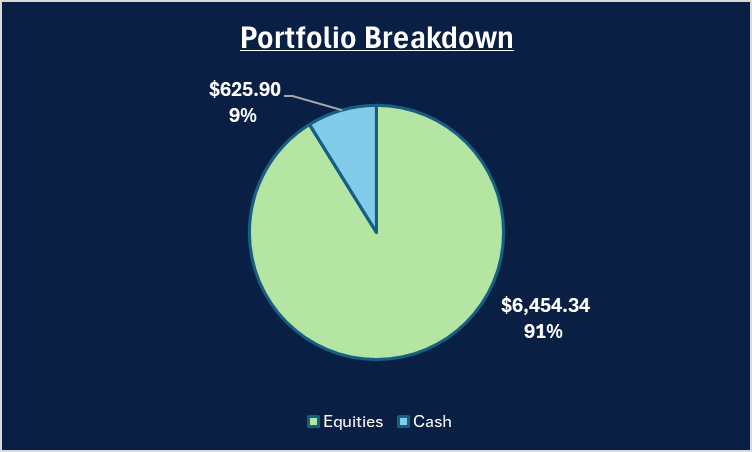

Portfolio Snapshot (31 Dec 2024)

This was a capital deployment month, reallocating from cash and under-performing equities into high yield ETFs. The cash buffer is now lean, signaling limited room for new positions unless more capital is injected. Nonetheless, the strong revaluation of core assets highlights the effectiveness of the income driven shift.

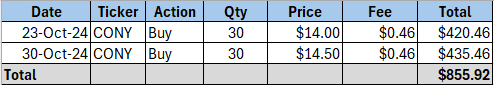

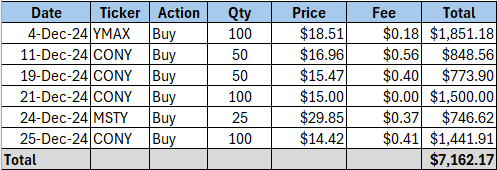

Key Transactions

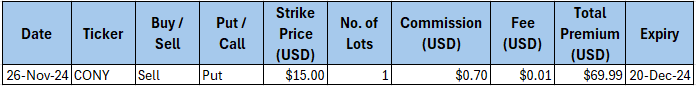

In December 2024, the portfolio underwent a significant repositioning towards income generating assets. A new 100 share position in YMAX was established early in the month, anchoring weekly yield generation. Similarly, the CONY position was expanded aggressively through 4 separate purchases totaling 300 additional shares. A small stake in MSTY (25 shares) was also initiated, signaling the beginning of exposure to Bitcoin linked dividend plays. To fund these moves, a partial equity exit was made on 20 Dec 2025 this shift resulted in a shrinking of the equity size by $439.22 and capturing profits from existing holdings. In total, over $7,100 was deployed to strengthen the core income engine of the portfolio, with the goal of consistent cash flow heading into the new year.

Lessons Learned

- Rapid accumulation of income positions proved effective, but it came at the cost of liquidity. The cash buffer fell from 12% to 7.2%, highlighting the need to preserve for opportunistic trades or option assignments.

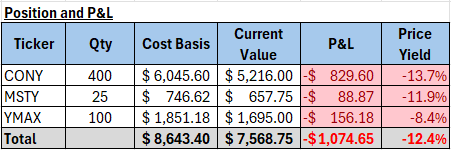

- A 12.4% drop in Core NAV masked the positive impact of income strategies. Despite generating a 2.2% yield from dividends and option premiums, the overall portfolio declined. This once again reminds us the importance of tracking total returns

- December’s erratic flows created sharp swings, but also opened attractive entry windows. Bulk buying earlier in the month may offer better fills before illiquidity and tax related selling pressures distort prices.

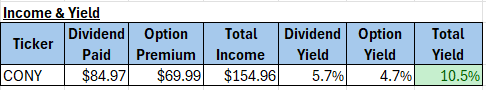

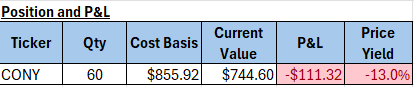

Core Income Position Total Return Analysis

The core portfolio ended the month with a total unrealized loss of $1,074.65, down 12.4% from the original cost. All 3 holdings were in the red, with CONY showing the largest dollar drop. Despite the price declines, the portfolio generated $192.69 in dividends, led by CONY and YMAX resulting in a modest 2.2% income yield. MSTY being a new addition, has yet to contribute any income. Overall, while capital values fell, the income stream has started to take shape.

Month 4 Objectives

- Deploy $3,000 across core ETFs

- Income target of $400 in dividends and option premiums

- Maintain 10 – 12 % of portfolio in cash for assignments, and tactical dip buys.

What is your playbook for balancing expansion and liquidity in choppy markets? Share your insights or questions in the comments below.