When Reality Hits

🌐 Market Update

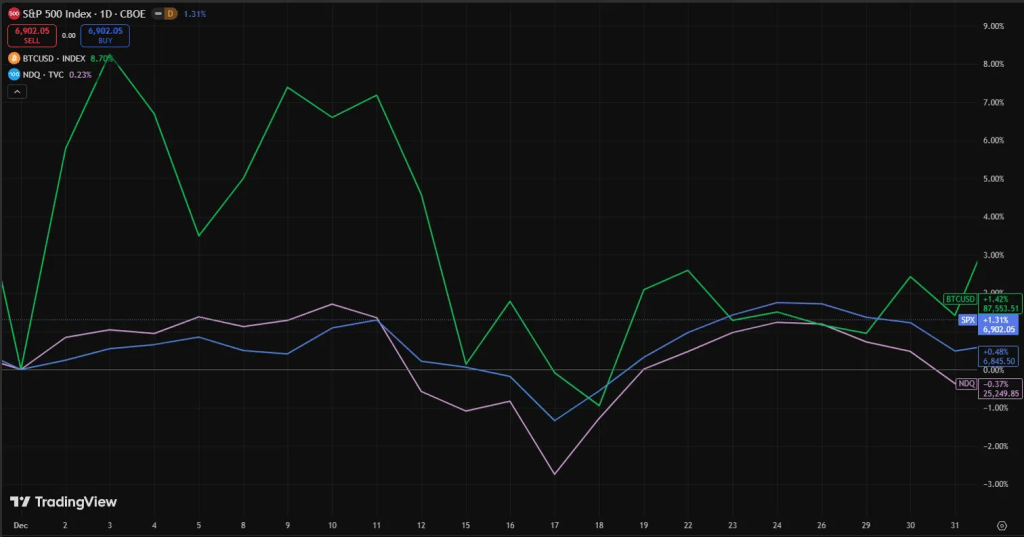

December delivered sharp reversals across markets. The S&P 500 closed up 1.2% after a volatile month. The Nasdaq finished flat. Bitcoin failed to rally and drifted lower through the entire period.

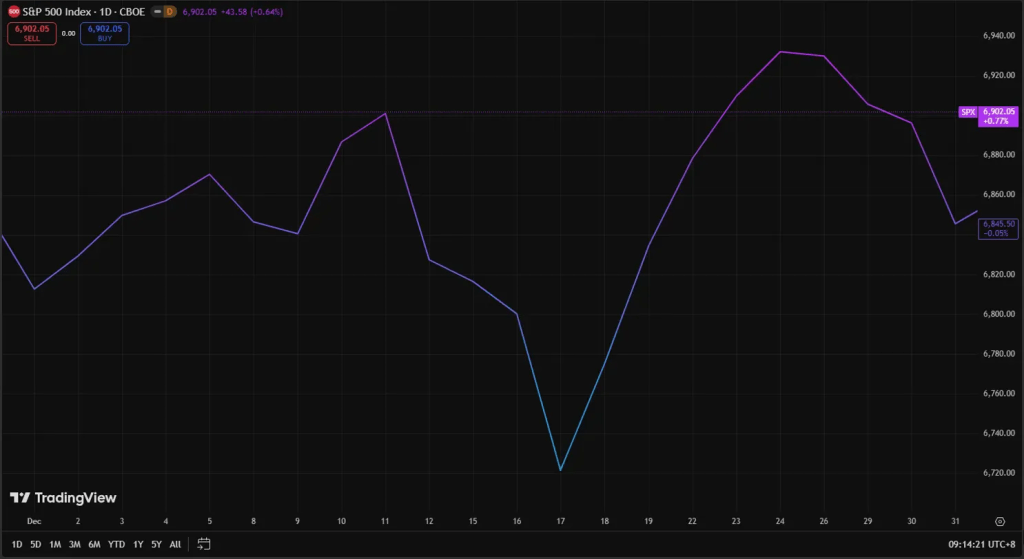

The S&P 500 climbed to 6,900 by mid-December. Then the Federal Reserve meeting on December 18th changed the tone. Chair Powell signaled just two rate cuts for 2026 instead of the four markets had been pricing. The index dropped 2.6% over the next few days, falling from 6,900 to 6,720.

The recovery was equally swift. Year-end positioning and Big Tech strength pushed the S&P back up 210 points to close at 6,902. December delivered the volatility but ended with a modest gain.

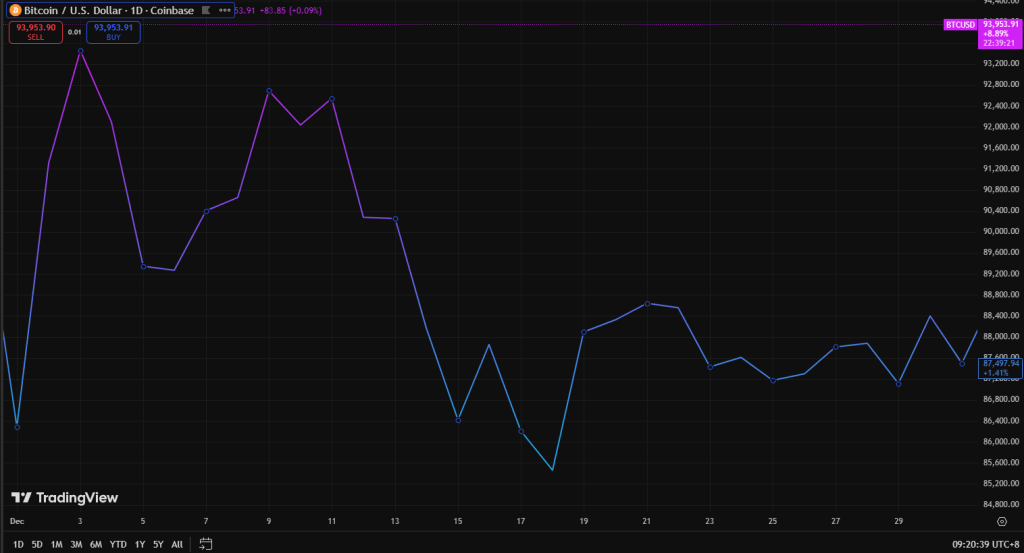

Bitcoin entered December under pressure after losing the $100,000 level in November. The expectation was for a holiday recovery rally into year-end. That recovery never materialized.

Bitcoin made a brief attempt to reclaim $95,000 in early December but was rejected. From there, the asset drifted lower through the rest of the month, closing near $87,600. The decline was not dramatic or volatile. It was a slow grind with no momentum.

Every bounce attempt in December was met with selling pressure. The pattern repeated throughout the month: small rallies that failed to hold, followed by steady drift lower. There was no conviction on the bid side and no catalyst strong enough to reverse the trend.

Despite the price decline, implied volatility remained compressed throughout December. This created challenging conditions for options-based strategies, which depend on elevated volatility to generate premium income. The month delivered a declining asset without the accompanying volatility expansion that typically occurs during sell-offs.

The Federal Reserve delivered its expected 25 basis point rate cut on December 18th, bringing the federal funds rate to 4.25% to 4.50%. The decision itself was anticipated. The forward guidance was not.

The updated economic projections showed only two rate cuts for 2026, down from four previously expected. Chair Powell emphasized persistent inflation pressures and resilient labor market conditions. Treasury yields rose 15 basis points over the following days. Credit spreads widened. Equity multiples compressed as investors repriced expectations.

Technology stocks held up better than the broader market. The Magnificent 7 names outperformed, supported by continued strength in AI infrastructure demand. Defensive sectors absorbed capital rotation in the second half of the month. Small-cap stocks and cyclical sectors underperformed through most of December.

🖋️ Opening Thoughts: A Lesson in Humility

The S&P 500 gained 1.2% in December. My portfolio fell 2.6%. I collected over $1,000 in distributions while the capital base shrank by more than double that amount.

The distributions arrived every week. So did the losses. Income couldn’t keep up with erosion.

The Yield Engine needed Bitcoin momentum and rising volatility. It got drift and compression instead. Bitcoin slid lower while equity volatility spiked, creating capital erosion without the premium income to compensate.

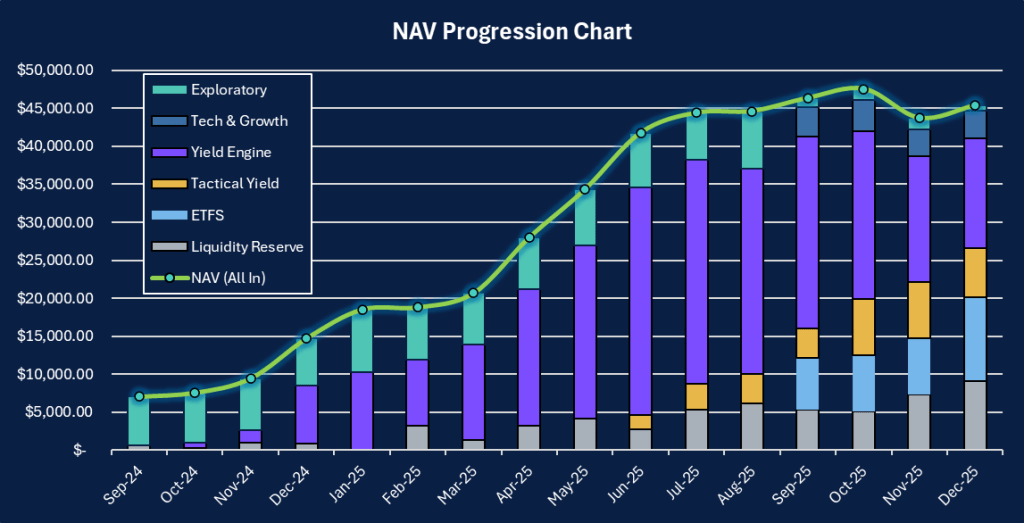

📊 NAV Progression

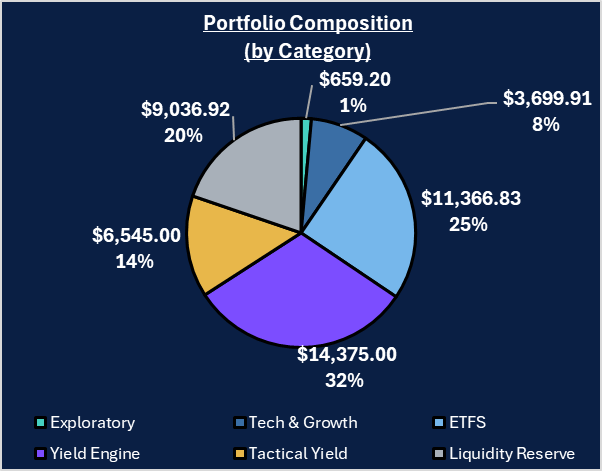

NAV climbed 4.3% to $45,683 in December. The headline number looks like recovery. It’s not. The portfolio deposited $3,086 and lost $1,117 organically. Without fresh capital, December would have been negative.

The Yield Engine was the primary drag. MSTY, CONY, and ULTY completed their reverse splits but continued declining. These positions generated $801 in distributions while the capital base contracted by $2,110. The sleeve closed at $14,375, down 12.8% for the month.

The ETF allocation moved in the opposite direction. A $3,952 deployment into VWRA pushed the category to $11,367, making it the portfolio’s second-largest sleeve at 25.0% of NAV. CSPX and IWDA added modest gains, providing stability while crypto-linked positions bled.

SOFI declined 11.9% to $6,545. Option premiums compressed as volatility faded into year-end. Tech and Growth added 3.5% to $3,700, supported by strength in Nvidia and semiconductors.

The Liquidity Reserve grew to $9,037, or 19.8% of NAV. Fresh capital and unreinvested income pushed the cash buffer to its highest level since portfolio inception. The elevated reserve positions the portfolio defensively heading into 2026.

🔑Key Takeaways

- NAV Grew on Fresh Capital

The portfolio closed at $45,683, up 4.5%. The gain came from a $3,086 deposit. Organic returns were negative at -$1,117. Without the deposit, December would have been red. - Income Target Met

Monthly income reached $1,009, breaking above $1,000 for the first time since October. Dividends contributed $801, options added $207. The 2.2% monthly yield came at the cost of significant capital erosion. - The Opportunity Cost of Income

The Yield Engine fell to $14,375, down $2,110 or 12.8%. MSTY, CONY, and ULTY completed reverse splits but continued declining. These positions paid out $801 in distributions while losing $2,110 in value. - Major ETF Deployment

VWRA received a $3,952 allocation, lifting the ETF sleeve to $11,367 or 25.0% of NAV. This deployment shifted the portfolio materially toward quality growth. - The Liquidity Shield

Cash reserves reached $9,037 or 19.8% of NAV, the highest level since inception. This buffer provides flexibility heading into 2026.

🧩Portfolio Updates

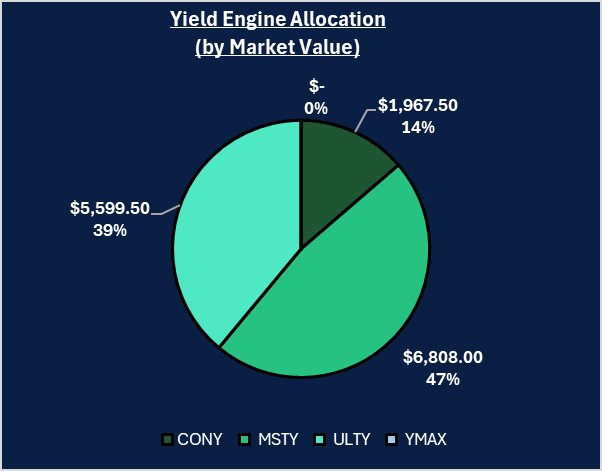

Yield Engine (MSTY, CONY, ULTY)

The Yield Engine closed at $14,375, down $2,110 or 12.8%. All three positions completed their reverse splits in early December.

| Ticker | End Value | Change | Post-Split Shares | Dividends |

| MSTY | $6,808.00 | -15.4% | 230 | $ 459.40 |

| CONY | $1,967.50 | -17.7% | 50 | $ 111.37 |

| ULTY | $5,599.50 | -7.4% | 150 | $ 230.67 |

| Total | $14,375.00 | -12.8% | $ 801.44 |

The sleeve represents 31.5% of the portfolio.

ETFs (CSPX, IWDA, VWRA)

The ETF sleeve grew to $11,367, up $4,020 or 54.7%, standing at 25.0% of NAV.

| Ticker | End Value | Change | Notes |

| VWRA | $4,623.80 | +588.0% | Includes $3,545 deployment |

| CSPX | $5,169.71 | +0.9% | Steady performance |

| IWDA | $1,573.32 | +1.4% | Broad market exposure |

| Total | $11,366.83 | +54.7% |

Tactical Yield (SOFI)

SOFI closed at $6,545, down $885 or 11.9%. Option activity generated $208 through selective put sales and call management. Premiums compressed as volatility faded into year-end.

Tech & Growth

This sleeve rose 3.5% to $3,700, representing 8.1% of NAV. Nvidia added $95, Cloudflare declined slightly, and Palantir held flat.

Exploratory Footprint

MetaOptics (9MT) was liquidated for a small gain. Luminor (5UA) remains at $33.

Liquidity Reserves

Cash reserves reached $9,037, or 19.8% of NAV. The reserve was built through fresh capital contributions, unreinvested dividends and option income, and proceeds from the 9MT exit.

🎯Objective Review

Here’s how December performed against the goals set in November:

Base Goals

Income Goal: Generate at least $1,000

Status: ✅ Achieved

Actual: $1,009

Income exceeded the target for the first time since October. Dividends contributed $802, with MSTY ($459), ULTY ($231), and CONY ($111) providing the bulk of distributions. Options added $208 through SOFI put sales and call management.

Deploy capital to reach ~14% liquidity

Status: ❌ Reversed

Actual: 19.8%

Liquidity increased instead of decreased. Fresh capital and unreinvested income pushed the reserve to $9,037. The deployment plan was abandoned in favor of preserving cash.

Strategic Deployment: Add to MSTY if Bitcoin holds $90k for 3 days

Status: ⏸️ Condition Not Met

Bitcoin drifted between $87,000 and $95,000 through December but never held $90,000 as firm support for three consecutive days. No deployment occurred. MSTY declined 15.4% through the month.

Maintain SOFI Collars

Status: ✅ Executed

SOFI option activity remained active. Put sales followed the 2.5% premium rule. Calls were managed defensively. Net option income: $208.

Stretch Goals

Income Above $1,250

Status: ❌ Missed

Actual income was $1,009, falling short of the stretch target.

Recover 50% of November Drawdown (+$1,900)

Status: ❌ Missed

NAV grew by $1,969, but $3,086 came from deposits. Organic returns were negative at -$1,117.

Deploy up to $2,500 if Bitcoin reclaims $100k

Status: ❌ Condition Not Met

Bitcoin never approached $100,000. The trigger was not met.

Circuit Breaker: Stop all deployments if Bitcoin closes below $85k for 3 days

Status: ✅ Not Triggered

Bitcoin never fell below $85,000. The circuit breaker was not needed.

Scorecard Summary

December met the income target and executed SOFI management within strategy. The decision to preserve liquidity instead of deploying into declining positions avoided additional losses. The conditional deployment rules functioned as designed, preventing premature entries into weakening assets.

📁Transactions

December Transactions

VWRA

On December 15th, 21 shares of VWRA were purchased at $168.70 for a total cost of $3,544.72. This deployment represented the largest single allocation of the year and shifted the portfolio materially toward global equity exposure. The position gained 2.08% by month-end.

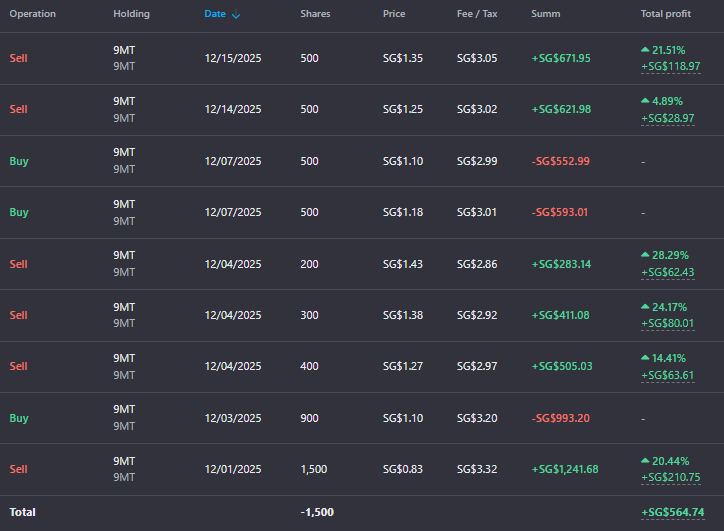

MetaOptics (9MT)

The 9MT position was actively traded throughout December before being fully liquidated. The sequence included multiple buys and sells as the stock fluctuated between $0.83 and $1.43. The final exit occurred on December 15th with the sale of 500 shares at $1.35. Total realized gain on 9MT trades for the month: $564.74.

SOFI Options

Option activity on SOFI generated $207.67 in net income through three put sales:

| Transact | Strike | Type | Capital @ Risk | Contracts | Premium (Gross) | Premium % | Expiry |

|---|---|---|---|---|---|---|---|

| 4-Dec | 27.00 | Sell Put | $2,700 | 1 | $66 | 2.44% | 19-Dec |

| 8-Dec | 26.00 | Sell Put | $2,600 | 1 | $60 | 2.31% | 19-Dec |

| 23-Dec | 27.50 | Sell Put | $2,750 | 1 | $85 | 3.09% | 02-Jan |

| Total | $8,050 | 3 | $211 | 2.62% |

December option activity achieved a 2.62% aggregate premium relative to capital at risk, exceeding the 2.5% monthly target.

🔭 Next Steps

January begins with 19.8% liquidity, a strengthened ETF base, and a Yield Engine that needs to prove it can stabilize. The priority is reducing risk while maintaining optionality.

- Monitor the Yield Engine

MSTY, CONY, and ULTY will remain in the portfolio through January, but on a tight leash. The positions generated $802 in distributions during December while losing $2,110 in capital. That 2.6:1 loss-to-income ratio is unsustainable. - Build the ETF Base

The VWRA deployment in December shifted the portfolio toward quality. January continues this path. The target is to bring the ETF sleeve to 30-35% of NAV by month-end. If the S&P 500 pulls back 3-5% in early January, deploy $1,500-$2,000 into CSPX and IWDA. If markets stay elevated, wait for a better entry. - Reduce Liquidity to 15-17%

The 19.8% cash position is defensively appropriate given December’s conditions, but it’s too high for productive capital deployment. The target is to bring liquidity down to 15-17% through a combination of earned income and strategic ETF purchases. - SOFI Tactical Management

SOFI will continue operating under the monthly aggregate premium framework. Target: 2.5% aggregate premium relative to capital at risk across all January trades. Per-trade floor: 2.0%. If SOFI drops below $24, consider adding shares directly rather than relying solely on options. The position has generated consistent income, but capital preservation takes priority.

📅 Month 16 Objectives

✅ Base Target

- Income Goal: Generate at least $1,000

December closed at $1,009. January should maintain this baseline. The target assumes Yield Engine distributions stabilize around $800-$900 and SOFI options contribute $200-$300 through the monthly aggregate premium framework (2.5% target, 2.0% floor). - Deploy $1,500-$2,000 into ETFs

Target allocation: 30-35% of NAV in the ETF sleeve by month-end. Deployment is conditional on market weakness. If the S&P 500 pulls back 3-5% in early January, deploy into CSPX and IWDA. If markets stay elevated, preserve liquidity and wait. - Reduce Liquidity to 15-17%

The current 19.8% cash position is too high for normal conditions. The goal is to redeploy strategically through ETF purchases and earned income while maintaining sufficient buffer for downside protection. - Maintain SOFI Aggregate Premium at 2.5%

Continue operating under the monthly aggregate premium framework. Each individual trade must meet the 2.0% floor. Month-end target: 2.5% aggregate premium relative to total capital at risk across all trades.

🚀 Stretch Goal

- Income Goal: Exceed $1,250

Capture elevated volatility if it emerges in early January. Option premiums typically expand around month-end and during market uncertainty. Push monthly income above $1,250 if conditions allow. - Organic NAV Growth of $2,000+

Achieve positive organic returns (excluding deposits) for the first time since October. This requires the Yield Engine to stabilize and ETF deployments to capture upside. Target: +4-5% organic growth. - Build ETF Sleeve to $15,000+

Add $3,500+ to the ETF allocation, bringing the sleeve above $15,000 and making it the portfolio’s largest category. This would represent a fundamental shift from yield-focused to quality-focused construction. - Bitcoin Reclaims $95,000

If Bitcoin breaks cleanly above $95,000 and holds for three consecutive days, consider selective re-entry into MSTY to lower cost basis. Deploy up to $1,000 only if momentum is confirmed. This is opportunistic, not required.

Risk Management

Primary Rule:

Capital preservation takes priority over income generation. If conditions deteriorate (Bitcoin below $85K, S&P down 5%+), all deployments stop and liquidity remains elevated above 17%.

🧠 Final Thoughts

December was a test of whether chasing yield makes sense when the underlying assets won’t cooperate. The answer was clear: it doesn’t.

I collected $1,009 in distributions and watched $2,110 evaporate from the Yield Engine. The math is simple. When capital erodes faster than income arrives, you’re not building wealth. You’re bleeding slowly while calling it cash flow.

The VWRA deployment was the first acknowledgment that something needed to change. Allocating $3,545 into a global equity fund won’t generate weekly payouts, but it also won’t compound losses through leveraged daily resets. Sometimes the best trade is the boring one.

2025 scaled the portfolio from $18,500 to $45,683. That’s a 2.5x increase, and it came from a combination of deposits, smart deployments, and income generation. But the last two months exposed the weakness in the approach. High yield and capital preservation are not the same thing. December made that impossible to ignore.

January starts with 20% liquidity, a stronger ETF base, and a clearer understanding of what works and what doesn’t. The question is whether I’m willing to act on it.

💬 Let’s Talk

December delivered Bitcoin weakness, compressed volatility, and a Fed pivot toward higher-for-longer rates.

How did you handle it? Did you hold through the drawdown in crypto-linked positions? Did you rotate into ETFs and quality names? Or did you exit to cash and wait for better conditions?

I’m also curious about your approach to yield strategies. Do you accept capital volatility as the cost of generating income, or do you prioritize stable NAV even if distributions are lower?

Drop your approach below.

Leave a comment