Slow Hands, Steady Gains

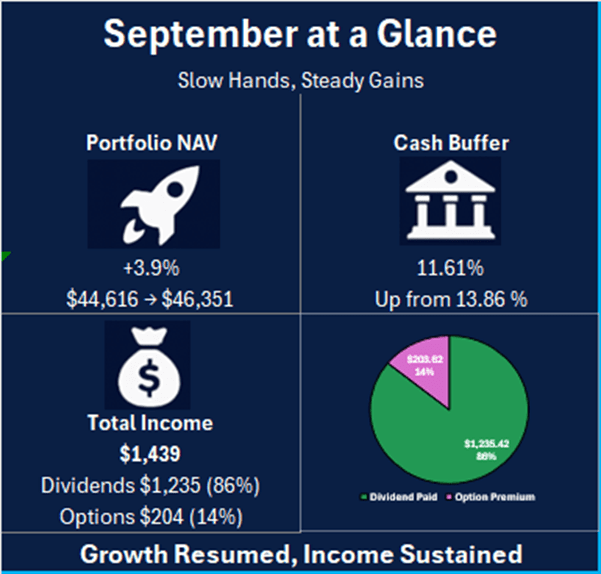

Growth +3.9%

Dividends $1,235.42

Option Income $203.62

Cash Reserve 11.61%

🖋️ Foreword

We are now entering the last quarter of the year.

A full year has passed since we started this journey. What began as a small experiment to track a new family of YieldMax funds has grown into something larger. The numbers have become a story of their own, one of discipline, resilience, and quiet intent.

Just as markets and technology evolves, so must we. Our portfolio must grow with them, shaped by the same clarity and purpose that guide the world we invest in. Each shift sharpens our blade and tests our strategy with greater intensity, reminding us that progress not only depends on speed, but also on precision.

September reflected that evolution. The new categories were introduced to bring sharper clarity to the composition of the portfolio, allowing for clearer segregation and the development of a more intricate sub-strategy within the system.

Bitcoin opened the month at $109,250, pushing higher through the first half of September to test $117,900. Momentum faded toward the end of the month as profit-taking set in, and by September 30, it closed at $114,056, marking a monthly gain of about 4.4%. The move was steady and controlled, a welcome sign of maturing sentiment.

The Nasdaq Composite showed similar strength. It started the month at $21,279, climbed steadily to a high of $22,801 mid-month, and ended September at $22,660, up 6.5%. Technology led the charge once again, supported by renewed optimism in artificial intelligence and a softer yield outlook from the Federal Reserve.

My portfolio moved in tandem with these trends. The Yield Engine (MSTY, ULTY) continued to generate steady dividends, delivering payouts even as share prices softened slightly. The ETFs (CSPX, IWDA and VWRA) did the heavy lifting, contributing to the bulk of this month’s gains. SOFI remained the tactical yield driver, benefiting from short-term volatility that helped capture consistent option premiums. Total income came in at $1,439, with $1,235 from dividends and $204 from option premiums.

All in all, it was not a month of dramatic swings, but one of stable and quiet growth, a reminder that progress is built on consistency, not intensity.

Let’s unpack it.

🖼️ Visual Summary

🔑Key Takeaways

- NAV Growth Continued

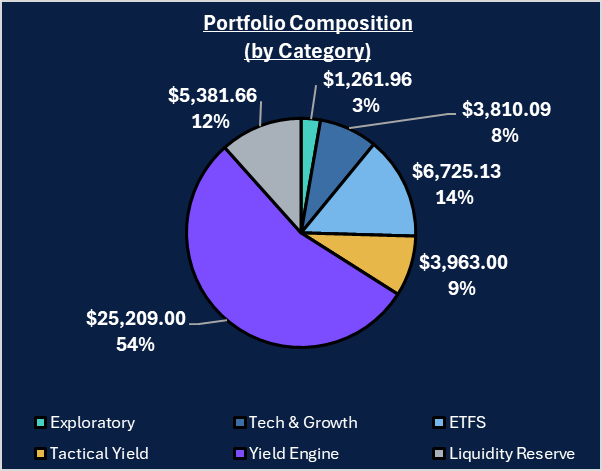

The portfolio rose 3.9% in September, closing at $46,351. Total equity value increased by $2,447, driven primarily by strong gains in ETFs (+60.0%) and a solid rebound across Tech & Growth (+11.7%) holdings. - Income Flow Remained Firm

Total income reached $1,439, with $1,235 from dividends and $204 from option premiums. Weekly flows from MSTY, ULTY, and CONY kept the income stream intact even as prices softened. - Liquidity Reserve Slightly Reduced

The Liquidity Reserve decreased by 12.9% to $5,381, reflecting redeployment of capital into ETF and exploratory positions. Despite the reduction, the cash buffer held at 11.6% of NAV, preserving flexibility for tactical trades in October. - Yield Engine Consolidated

The Yield Engine closed at $25,209, down 6.9% month-on-month. MSTY saw a 9.9% drawdown, while ULTY slipped 3.5% Steady distributions helped offset these decline and sustained portfolio income., - ETFs Led the Recovery

The ETF segment (CSPX, IWDA, VWRA) grew from $4,202 to $6,725, a gain of $2,523 (+60%). This category was the top contributor to NAV growth, supported by increased investments and a strong September rally in the S&P 500 and global markets. - SoFI Continued as a Tactical Engine

SOFI, the sole Tactical Yield position, rose 3.4% to $3,963. Option premiums remained the main yield driver, complementing dividend income from the Yield Engine. - Tech & Growth Strengthened

This segment climbed 11.7% , led by NET (+27% ), NVDA (+7% ), and BB (+27% ). Selective exposure to tech names proved effective as the Nasdaq advanced 6.5% for the month. - Exploratory Growth Awakened

The Exploratory Growth segment surged from $1.29 to $1,261.96, up 977% , reflecting new allocations into 640 (HKEX) and 9MT (SGX). While still a small portion of NAV (2.7% ), it adds regional diversity and optional upside. - Portfolio Structure Reinforced

September completed the transition into a six-category framework: Yield Engine, ETFs , Tactical Yield, Tech & Growth, Exploratory Growth, and Liquidity Reserve.

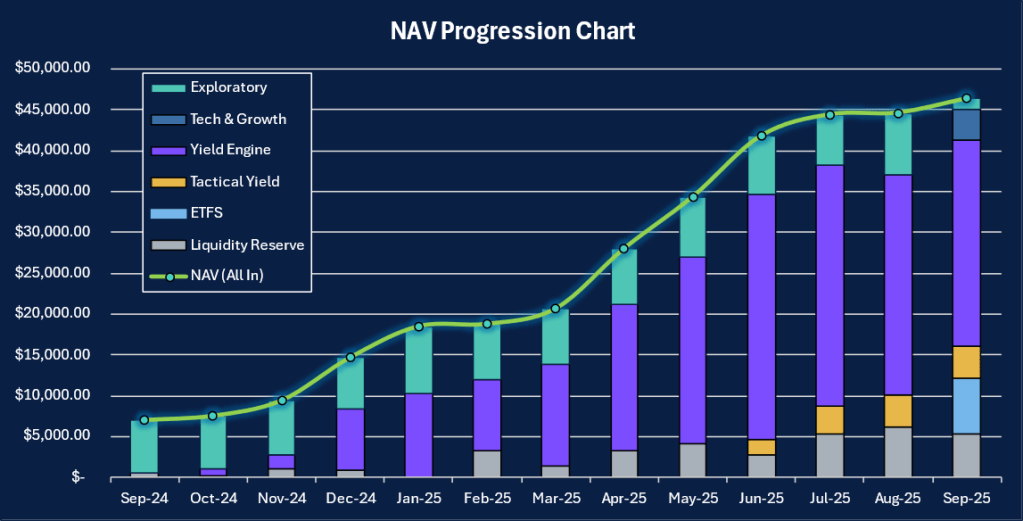

📊 NAV Progression

September closed with the portfolio at $46,351, up 3.9% from August’s $44,616. The increase was moderate but broad-based, marking the third consecutive month of positive growth.

The ETFs led performance once again, climbing 60% to $6,725. 2 new CSPX shares and 5 additional IWDA shares were added during the month, strengthening long-term stability and global diversification. Together with VWRA, the ETF segment now represents 14.5% of NAV and serves as the portfolio’s defensive backbone.

The Yield Engine, still the largest allocation at 54.4% , eased slightly to $25,209 as MSTY and ULTY prices softened. Even so, the segment continued to generate weekly income and remains the portfolio’s primary cash-flow source.

The Tactical Yield sleeve, represented by SOFI, advanced 3.4% to $3,963. Short-term option selling kept returns steady while controlling downside exposure.

Tech & Growth positions gained 11.7% , ending at $3,810. Strength in NET (+27% ), BB (+27%), and NVDA (+7%) lifted the segment as the Nasdaq rose 6.5% for the month.

The Exploratory Growth category, including 640 (HKEX), 9MT (SGX), and 5UA (SGX) — expanded to $1,262 or 2.7% of NAV, reflecting a deliberate step into regional and small-cap opportunities.

Lastly, the Liquidity Reserve stood at $5,382, or 11.6% of NAV. The minor drawdown reflects the ETF purchases while keeping a healthy buffer for tactical moves in the final quarter.

Overall, September showed quiet strength. Yield engines held their ground, global ETFs took the lead, and new categories brought structure and clarity to both risk and return.

🧩Portfolio Updates

ETFs Expanded

Selective additions were made to the ETF layer with two CSPX and five IWDA shares added in September. The goal was simple. To strengthen the base of long-term stability and compound growth while maintaining balance against higher-yield exposures.

Yield Engine Held Course

No new positions were opened within the Yield Engine. MSTY and CONY continued their monthly payouts, while ULTY delivered steady weekly flows. Price softness in MSTY and ULTY was offset by consistent distributions, keeping income momentum intact.

Tactical Yield Stayed Light

SOFI remained the only active tactical yield play. Options were managed selectively, capturing premiums without increasing margin exposure. No additional contracts were opened at month-end, keeping risk measured and liquidity ready for Q4 opportunities.

Tech & Growth Retained

Core tech names NVDA, NET, and PLTR were maintained with no new entries. These remain satellite growth drivers, kept intentionally small to preserve portfolio balance while participating in the sector’s recovery.

Exploratory Footprint Initiated

September marked the first deployment into the Exploratory Growth sleeve, introducing 640 (HKEX) and 9MT (SGX). Allocations are small by design, allowing gradual observation of market response before scaling exposure.

Liquidity Managed

Cash levels were trimmed slightly following ETF purchases, yet the 11.6% buffer remains intact. The reserve continues to serve as both protection and optional firepower for tactical entries should volatility resurface.

🌐 Market Update

Volatility & Rates

What was expected

September began with markets expecting volatility to ease further after a calm August. Softer inflation data and stable macro readings supported the idea that the VIX would drift lower toward the 14–15 range, while Treasury yields were expected to hold steady. Analysts anticipated another quiet month driven by cautious optimism and lower market stress.

What happened

Instead, volatility edged higher. The CBOE Volatility Index (VIX) gained about one point, closing at 16.28 on 30-Sep-2025, within an intraday range of 16.02 to 16.70. This marked its second consecutive monthly increase, even as both the S&P 500 and Russell 2000 posted solid gains. Treasury yields were little changed, with the U.S. 10-year ending the month near 4.25% . The slight rise in VIX reflected modest hedging rather than panic, suggesting investors were securing profits while remaining engaged in risk assets.

How the portfolio responded

The portfolio maintained a steady stance amid the uptick in volatility. The mild increase in option premiums benefited SOFI’s tactical spread strategy, while core holdings such as MSTY and ULTY continued to deliver consistent weekly distributions. The ETFs held firm as yields stabilized, reinforcing balance between income and growth positions. Overall, the portfolio benefited from a market that was calm but cautious, favoring income continuity over speculative expansion.

Crypto & Equity Performance

What was expected

Coming out of August’s mild drawdown, most analysts expected a subdued month for crypto. Liquidity remained thin, ETF inflows had slowed, and sentiment pointed toward consolidation rather than breakout. Bitcoin was forecast to trade quietly around the $110,000 level, with limited volatility.

What happened

Crypto markets instead delivered a measured rebound. Bitcoin opened September at $109,250 and climbed to $117,900 mid-month before easing to close at $114,056, up 4.4% . Volatility narrowed, and trading volumes stabilized. Ethereum underperformed slightly as ETF inflows cooled but continued to attract institutional demand. The tone was constructive, marked by steadier price action and reduced speculative churn.

How the portfolio responded

The Yield Engine maintained consistent performance. CONY, which tracks Coinbase through an option-income strategy, provided steady distributions despite reduced crypto volatility. Exposure to MSTY and ULTY remained unaffected, ensuring stable income flow even as crypto markets consolidated. The portfolio maintained minimal direct crypto exposure, choosing instead to capture yield through structured products rather than price speculation.

Outlook for October

October will be a test of discipline. Markets have regained their footing, yet confidence remains fragile. The slight rise in volatility at the end of September hints that investors are still hedging against surprises, while economic data continues to balance between strength and fatigue.

Attention will turn to Washington, where uncertainty surrounding a potential U.S. government shutdown could momentarily unsettle markets. Historically, such events tend to lift short-term volatility and weigh on investor sentiment, though the impact often fades once a funding resolution is reached. For now, the risk is more psychological than structural, but it adds another layer of caution to an already delicate environment.

Equities may see slower momentum as valuations stretch and earnings guidance takes the spotlight. Technology remains resilient, but leadership could rotate toward sectors that benefit from stable yields, such as financials and infrastructure. The portfolio’s ETF base will continue to anchor this transition, providing balance if short-term pullbacks emerge.

For the Yield Engine, October will focus on consistency rather than expansion. MSTY, CONY and ULTY will continue to provide dependable periodic payouts. The goal is to preserve cash flow and use any brief volatility spikes as opportunities to accumulate income assets.

The Tactical Yield sleeve, anchored by SOFI, will stay selective. Option spreads will be deployed only when risk-reward aligns, keeping exposure light and premiums steady.

In essence, October is not about chasing momentum but maintaining rhythm. The portfolio enters the month well-positioned: cash at 11.6% , yield engines intact, and global exposure balanced. The focus now shifts from recovery to refinement. Staying patient, staying funded, and letting quiet compounding do its work.

🎯Objective Review

Here’s how we performed against our August targets at a glance:

Base Goals

✅ Income Goal: Generate at least $1,200 — Exceeded

Total income reached $1,439, comprising $1,235 in dividends and $204 in options premiums.

✅️ Cash Reserve: Maintain between 10% and 14% of NAV— Met

Reserves ended at 11.6 % of NAV, within range and near the midpoint of the target band. The portfolio maintained ample flexibility for tactical opportunities without overextending exposure.

✅ Option Selling: Focus only if premium exceeds 2.5% — Met

SOFI remained the sole option engine. All puts cleared the 2.5% return hurdle and were managed with short expiries. No positions were left to assignment.

Stretch Goals

✅ Total Income: Exceed $1,500 — Slightly Missed

September’s $1,439 came close but fell short of the stretch mark. The absence of a double MSTY payout (which boosted August) kept overall income slightly below target, though yield stability remained intact.

✅ NAV Growth: Add $2,000 to $3,000 — Met

NAV grew 3.9 %, from $44,616 to $46,351, driven by ETF strength and broad equity gains. The rebound in Tech & Growth positions, combined with steady yield flow, provided the lift needed to outpace expectations.

✅ Selective Reinvestment: Add ULTY or MSTY — Deferred

Neither fund presented an attractive discount during the month. Focus shifted toward strengthening ETF exposure instead, prioritizing global diversification over concentrated yield expansion.

✅ Risk Discipline: Limit to one SOFI CSP — Met

All SOFI trades were capped at a single active position. Exposure stayed defined, duration short, and profits consistently locked in. Risk discipline remained central to the strategy.

📁Transactions

August Transactions

- CSPX

Expanded further with two new entries at $700.01 and $712.70, lifting exposure to the S&P 500 core. The additions strengthened long-term stability and reinforced the ETF layer as a defensive anchor. - IWDA

Added five shares at $123.35, broadening diversification into global developed markets. This complements CSPX and supports the long-term allocation strategy within the Global Core ETFs segment. - VWRA

Initiated a small add of 2.1 shares at $163.97, rounding out global equity exposure and deepening passive diversification across regions. - 640 (HKEX)

Acquired 4,000 shares at HK$1.21 to establish a foothold in Exploratory Growth. This position reflects selective exposure to Hong Kong’s small-cap opportunities while keeping sizing prudent. - 9MT (SGX)

Actively traded through multiple small blocks between SG$0.39 and SG$0.73. Partial sales were executed to manage cost basis and rebalance short-term liquidity. The overall stake remains positioned for recovery momentum. - Liquidity Reserve

Received a $1,562 deposit. Ended the month at 11.6% of NAV, maintaining flexibility for tactical deployment in October.

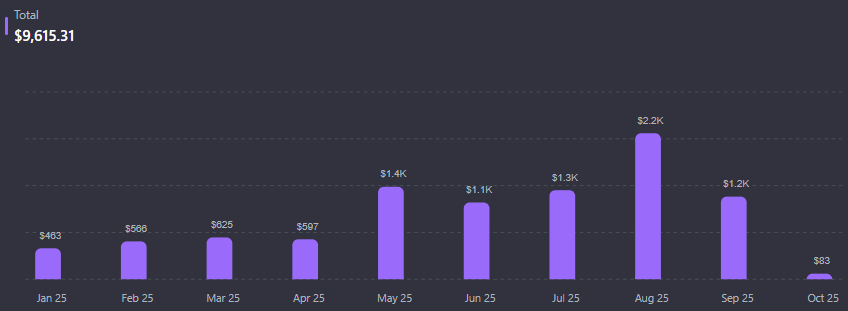

🏦 Income Overview

September delivered $1,439 in total income, composed of $1,235 from dividends and $204 from options premiums. Though smaller than August’s double-payout surge, the consistency underscored the system’s resilience.

Dividend Highlights ($1,235)

- MSTY: $742.72, reduction due to single payment this month.

- ULTY: $334.43, distributions slightly lower due to market softness

- CONY: $158.27, a slight increase compared to August.

Option Activity ($204)

- All option trades in September came from SoFI

- A total of 4 short puts were written and subsequently closed for profit.

- Premiums were taken early, with no assignments or unnecessary exposure.

Yield Profile

- Overall Yield: 3.5 %

- Dividends: 3.0 %

- Options: 0.5 %

Income this month was characterized by continuity over surprise. The system functioned exactly as designed.

🔭 Next Steps

The portfolio enters October on solid footing. Income has stabilized, volatility remains contained, and cash reserves sit comfortably above target. The focus now shifts from rebuilding to refining, strengthening structure, tightening execution, and positioning for a measured fourth quarter.

Area of Focus

- Reinforce the Core

Continue gradual additions to CSPX and IWDA when prices consolidate. These ETFs now form the backbone of stability, balancing high-yield volatility with steady capital appreciation. - Maintain Yield Discipline

Keep MSTY and ULTY as primary income engines. Accumulate only if dividend cadence remains uninterrupted and prices dip below intrinsic support. CONY will remain a supplementary yield stream, not a core holding. - Tactical Flexibility with SOFI

Continue deploying options selectively. Only engage when premiums exceed the 2.5% return threshold and risk-reward remains favorable. Volatility spikes linked to U.S. fiscal uncertainty may present brief but attractive entry windows. - Preserve Liquidity Buffer

Maintain the cash reserve near 11–12%. This ensures readiness to seize value opportunities without diluting dividend efficiency. Any excess inflow can be directed toward ETF accumulation later in the quarter. - Monitor Macro Signals

Watch the U.S. government shutdown debate and Treasury yield movement closely. A prolonged stalemate or renewed rate volatility could trigger market dips worth exploiting.

📅 Month 12 Objectives

✅ Base Target

- Income Goal:

Generate at least $1,300 in total income, primarily through dividends, with SOFI options as tactical supplement. - Liquidity Reserve:

Maintain cash reserves between 10% and 12% of NAV to preserve flexibility. - Equity Exposure:

Add to CSPX or IWDA only on meaningful pullbacks. The goal is gradual reinforcement of the ETF core, not aggressive accumulation. No new positions outside current categories unless cash reserves exceed 12 percent. - Option Selling:

Focus on SOFI and MSTY puts only if premiums exceed 2.5% return on collateral, with expiries under 14 days. - Yield Engine Stability:

Hold MSTY, ULTY, and CONY through volatility. Monitor payout trends closely. No averaging down unless distributions remain intact and drawdown exceeds 5 percent from current levels.

🚀 Stretch Goal

- Total Income:

Exceed $1,500, supported by double MSTY payout and steady ULTY weekly flows. - NAV Growth:

Lift NAV by $2,000 to $3,000 through earned income and selective reinvestment. - Strategic Deployment:

Allocate up to $2,000 into CSPX, IWDA, or VWRA if market sentiment weakens mid-month. Reinforce the stability pillar ahead of Q4 income cycles. - Maintain Risk Discipline:

Limit to one active SOFI CSP at a time unless reserves exceed 12%. Keep sizing controlled. - Exploratory Layer

Monitor 640 (HKEX) and 9MT (SGX). Add only on clear technical strength or sustained volume breakout. Keep allocation below 3 percent of NAV.

The goal is to let structure do the work. To stay patient, keep yield steady, and let the compounding take care of the rest.

🧠 Final Thoughts

The twelfth month marked a turning point. What began as an experiment in income has matured into a living, breathing system that balances yield, growth, and patience in equal measure. The numbers have become quieter now, but more deliberate, shaped not by chance, but by rhythm.

Markets rose, volatility stirred, and yet the portfolio stood firm. The income engine continued its steady hum while the core expanded in quiet strength. Every trade, every dividend, every option premium was another step in refining the system.

As the final quarter unfolds, the task ahead is no longer expansion but precision. The structure works. It only needs time to deepen its roots.

Slow hands. Steady gains. That is how the year will close.

💬 Let’s Talk

How are you adjusting your portfolio as the year enters Q4?

Are you building, holding, selling?

Share your thoughts below.

Leave a comment