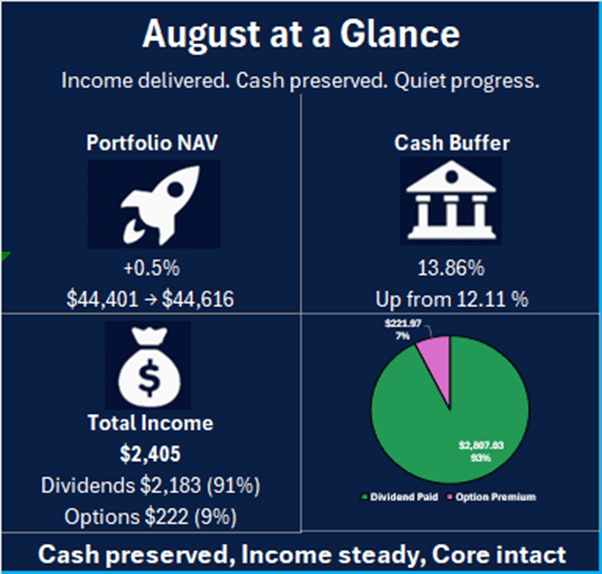

Growth +0.5%

Dividends $2,183.33

Option Income $221.97

Cash Reserve 13.86%

🖋️ Foreword

I am posting this a little later than usual. Life kinda got in the way this month. However, i still believe August 2025 deserved a proper entry.

The month moved with a split rhythm, one heavy, the other hopeful.

Bitcoin started off strong from $117,000 to test $124,000 mid month. That momentum did not last, and was soon halted. Heavy selling broke through the support levels and by end of August, it closed at $109,380.

The Nasdaq told a different story. It opened near $22,800, pushed to a peak of $23,900 around mid-month. Then settled, closing at $23,485 at the end of August.

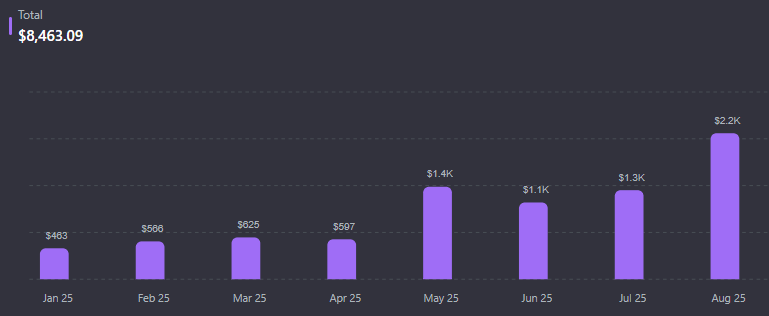

My portfolio sat in the middle of this contrast. Yield engines like ULTY and MSTY faltered, with prices trending downwards and dividends reduced. SoFI, on the other hand continued to climb. Even so, August brought in $2,200 in dividends, driven by a double payment from MSTY. It was a reminder that while value swings are out of my hands. the income stream keeps this strategy alive.

Let’s unpack it.

🖼️ Visual Summary

🔑Key Takeaways

- NAV Growth Continued

The portfolio grew by 0.5% in August. NAV rose from $44,401 to $44,616, supported by a fresh capital deposit of $3,107.86. Price weakness offset part of the contribution, leaving only $215 net growth after adjusting for the deposit. - Income Reached a New Peak

August’s income totaled $2,405. Dividends contributed $2,183 (91%), lifted by a double MSTY payout, while options added $222 (7%). - Cash Position Strengthened

Cash reserves improved again, climbing from 12.1% in July to 13.9% by end-August, giving more flexibility for tactical deployment. - MSTY Remained the Income Driver

MSTY delivered the largest share of dividends this month, with the double payout boosting results. ULTY and CONY added steady flows, while SOFI contributed through option premiums. - ULTY Expansion Accelerated

550 Shares added in August, reinforcing its role as a core weekly income engine. - ETF Exposure Broadened

CSPX (2 Shares) added to anchor long term stability alongside high yield plays - SoFI Continued as a Tactical Engine

SoFI’s price climb created room for tactical option selling. Active management generated $222 in net premiums, reinforcing its role as a growth and options overlay. - Core Focus Stayed on Yield Stability

No major shifts in holdings this month. Capital remained centered on high-yield engines MSTY, ULTY, and CONY, with broad ETF exposure through CSPX and IWDA acting as stability anchors.

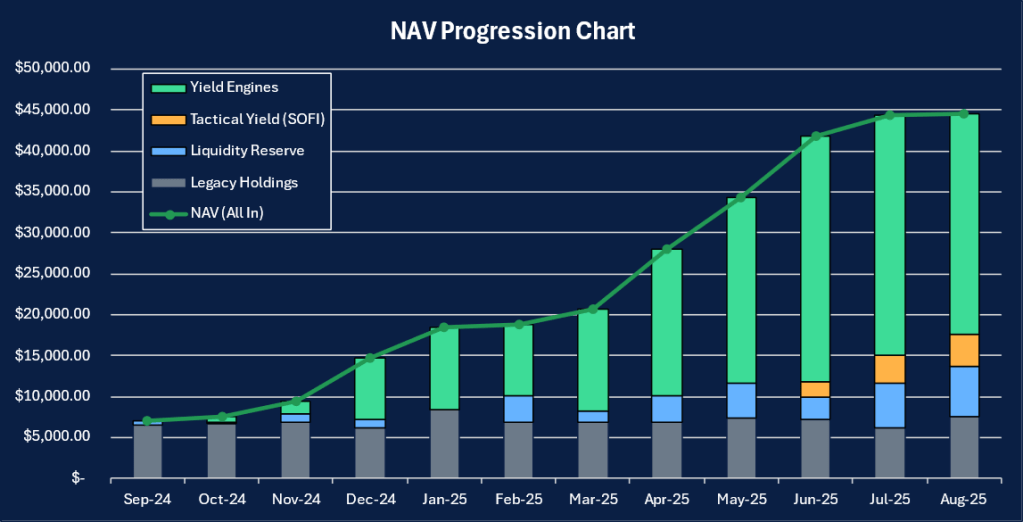

📊 NAV Progression

NAV inched up from $44,401 to $44,616 in August, a modest 0.5% increase. This was supported by a cash deposit of $3,107.86, but weakness across MSTY and ULTY offset most of the contribution. Net portfolio growth after adjusting for the deposit was just $215.

Yield-focused positions like MSTY, CONY, and ULTY remain the backbone of the portfolio, making up the largest share of NAV. Despite price pressure, their dividend flows kept the income line resilient.

The cash buffer grew from 12.1% to 13.9%, giving more flexibility to act on opportunities without forced sales.

SoFI continued to provide tactical income through options, complementing the steady weekly flows from ULTY.

No fireworks, no fanfare, just the quiet rhythm of income keeping pace.

🧩Portfolio Updates

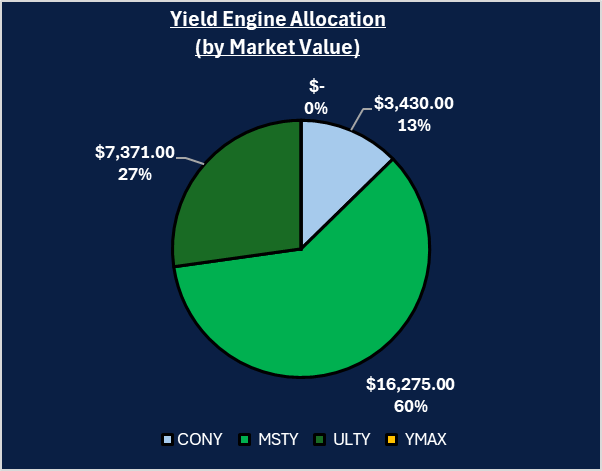

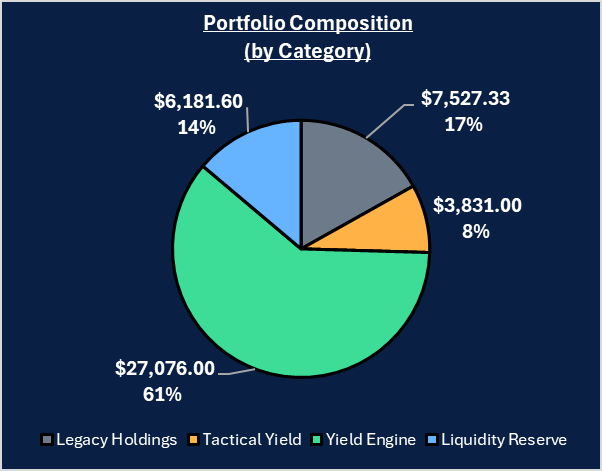

The portfolio ended August at $44,616, with allocations holding steady. The Yield Engine (MSTY, CONY, and ULTY) still dominated at 60.7% of NAV, supported by 8.6% in Tactical Yield (SoFI), 16.9% in Legacy Holdings, and a 13.9% cash reserve.

MSTY closed the month at -20.5%, even though its double dividend was the largest single income driver. CONY fell -21.2% weighed down by Coinbase weakness, but dividends continued. ULTY expanded from 750 to 1,300 shares, adding resilience and lifting income. despite price drawdowns.

SOFI remained a tactical engine, contributing through options premiums. At 8.6% of NAV, it’s a meaningful position but still leaves room to scale if conditions remain favorable.

Legacy equities accounted for 16.9%, while cash climbed to 13.9% of NAV, aided by a fresh deposit of $3,107.86. Together, they provided balance and the flexibility to adjust without being forced by volatility.

Overall, core income positions declined 8% in value, but this was partly offset by strength in other equities (+18.5%) due to purchase of CSPX and IWDA, as well as the growing reserve. The structure held, and the focus stayed on steady reinforcement rather than reinvention.

🌐 Market Update

Volatility & Rates

What was expected

August was set up to be quiet. The VIX had been steady, and there was little reason to expect a shake-up. The Fed had already guided toward holding rates until year-end. Markets assumed more of the same. They expected stable rates and stable premiums. They also anticipated a backdrop for steady option income.

What happened

That calm mostly played out. The Fed held steady, and the VIX stayed in range, closing the month just under 16. The stronger dollar was the quiet disruptor, weighing on crypto while equities took it in stride.

How the portfolio responded

Premiums stayed firm enough to collect without taking on extra risk. SOFI options were harvested steadily, and MSTY’s swings fattened yields even as the stock lost ground. With the cash buffer growing, there was no pressure to force trades.

Crypto & Equity Performance

What was expected

Bitcoin was expected to hover above 115k, maybe even make a push for 125k if inflows stayed strong. Nasdaq looked supported by tech earnings and steady policy. YieldMax names were expected to trail the broader market but hold their income lines.

What happened

Bitcoin did surge early, touching 124k mid-month, before a whale sale and softer ETF inflows dragged it back to close at 109,380. Nasdaq ran the opposite way, peaking at 23,900 and closing the month at 23,485, a gain over August.

YieldMax equities, did not follow crypto higher.

- MSTY dropped 20.5% despite Bitcoin’s early push.

- CONY slid 21.2% as bearish sentiment stayed heavy on Coinbase.

- ULTY was scaled from 750 to 1,300 shares, reinforcing income but not price.

SOFI drifted sideways but kept paying through options, proving its worth as a tactical income tool.

How the portfolio responded

Most SOFI puts were closed early for profit. MSTY’s double dividend turned into August’s highlight, driving monthly income past 2,400. ULTY’s larger base added stability, showing that size of position matters more than short-term price swings. Despite equity losses, income stayed steady and kept the system intact.

Outlook for August

Volatility is expected to hover in the high teens. CPI and jobs data may stir short bursts, but premiums should remain rich enough to reward discipline.

Bitcoin may retest 115k if flows stabilize, though sideways chop is just as likely. YieldMax funds should remain mixed. MSTY could bounce if Bitcoin steadies. CONY needs sentiment on Coinbase to recover. ULTY should keep paying week after week. SOFI stays volatile but tradeable for those willing to manage closely.

The path is unchanged. Stay patient, hold liquidity, and avoid overreach. The aim is not to trade harder, but to trade better.

🎯Objective Review

Here’s how we performed against our August targets at a glance:

Base Goals

✅ Income Goal: Generate at least $1,000 — Exceeded

August delivered $2,183 in income, driven by MSTY’s double dividend and a larger ULTY base. Options added $222 through SOFI puts. The goal was not only reached but tripled.

✅️ Cash Reserve: Maintain between 8% and 10% of NAV— Met

The reserve ended at 13.9% of NAV, up from 12.1% in July. A $3,107 deposit provided the lift, ensuring liquidity stayed above target and flexibility was preserved.e.

✅ Option Selling: Focus only if premium exceeds 2.5% — Met

SOFI remained the sole option engine. All puts cleared the 2.5% return hurdle and were managed with short expiries. No positions were left to assignment.

Stretch Goals

✅ Total Income: Exceed $1,300 — Surpassed

The stretch goal was cleared comfortably, with August income more than doubling the target. Dividend flows did the heavy lifting, supported by disciplined SOFI premiums.

✅ NAV Growth: Add $2,000 to $3,000 — Missed

NAV rose just 0.5%, from $44,401 to $44,616. After adjusting for the $3,107 deposit, true growth was only $215. Weakness in MSTY (–20.5%) and CONY (–21.2%) erased most of the inflows.

✅ Selective Reinvestment: Add ULTY or MSTY — Executed

Additional ULTY shares were purchased, raising holdings to 1,300. This improved weekly payout stability and offset some of the decline in MSTY.

✅ Risk Discipline: Limit to one SOFI CSP — Met

No more than one SOFI position was open at a time. Trades were sized carefully and closed early once premiums were secured. Discipline was upheld.

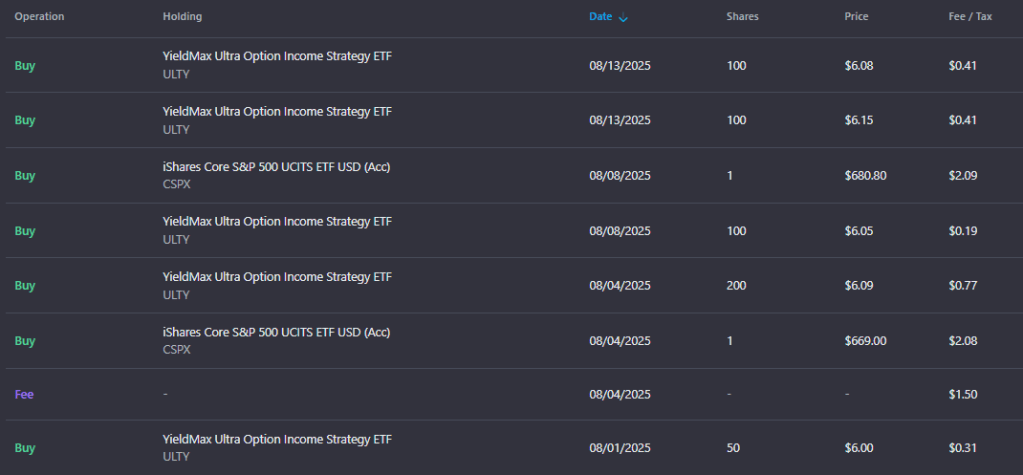

📁Transactions

August Transactions

- ULTY

Expanded aggressively. Purchases across the month lifted the position from 750 shares to 1,300. The staggered entries between $6.00 and $6.15 locked in a stronger base for weekly dividends. - CSPX

Increased with two small adds at $669 and $680.80, reinforcing long-term ballast in the portfolio. - ULTY

Received increased allocation after the YMAX exit. Its weekly dividends continued without disruption, offering smoother payout cadence. - Cash

Received a $3,107 deposit, pushing reserves from 12.1% to 13.9% of NAV.

🏦 Income Overview

August delivered the strongest income line so far, totaling $2,405

Dividend Highlights ($2,183)

- MSTY: $1,670.96, boosted by the double dividend cycle.

- ULTY: $392.04, reflecting the expanded base of 1,300 shares.

- CONY: $120.33, steady despite price weakness.

Option Activity ($222)

- All option trades in August came from SoFI

- A total of 6 short puts were written and subsequently closed for profit.

- Premiums were taken early, with no assignments or unnecessary exposure.

Yield Profile

- Overall Yield: 5.0 %

- Dividends: 4.5 %

- Options: 0.5 %

Even as prices slipped, cash flow remained firm. Dividends dominated, while SOFI’s options added tactical balance. The month proved again that income sustains the portfolio more reliably than price marks.

🔭 Next Steps

September will be about holding the line, not overreaching. With Bitcoin shaken by heavy selling and equities leaning on fragile support, the portfolio will move with caution. MSTY, ULTY, and CONY stay as the core anchors, while SOFI remains a tactical lever. The focus now is steady income, controlled risk, and keeping cash reserves ready for when opportunity strikes.

Area of Focus

- Protect the Yield Core

MSTY, ULTY, and CONY continue to pay reliably. Keep allocations steady, let the dividends work. - Tighten SOFI Use

Sell puts only above the 2.5% hurdle. Favor short expiry, keep sizing small, and avoid stacking exposure. - Brace for Macro Moves

Tariff headlines, inflation prints, and Fed signals may jolt markets. Mark exit levels early and act with intent if swings open room for gains. - Defend the Cash Reserve

Reserves near 14% provide flexibility. Keep them above 10% and avoid equity buys unless they clearly enhance income or stability.

📅 Month 12 Objectives

✅ Base Target

- Income Goal:

Generate at least $1,200 in total income, primarily through dividends, with SOFI options as tactical supplement. - Cash Reserve:

Maintain cash reserves between 10% and 14% of NAV to preserve flexibility. - No New Equity Buys

Avoid new equity purchases unless reserves stay above 12% and the trade strengthens yield reliability. - Option Selling:

Focus on SOFI and MSTY puts only if premiums exceed 2.5% return on collateral, with expiries under 14 days.

🚀 Stretch Goal

- Total Income:

Exceed $1,500, supported by double MSTY payout and steady ULTY weekly flows. - NAV Growth:

Lift NAV by $2,000 to $3,000 through earned income and selective reinvestment. - Selective Reinvestment:

Consider adding to ULTY or MSTY if prices weaken but dividends remain intact. - Maintain Risk Discipline:

Limit to one active SOFI CSP at a time unless reserves exceed 12%. Keep sizing controlled.

These objectives keep September framed as a month of discipline and preservation. They also leave space to capture upside if volatility turns in our favor.

🧠 Final Thoughts

August showed me once again that income is the anchor. Prices on MSTY, CONY and ULTY slipped, but dividends reached their highest level yet, and SOFI’s options added steady support. NAV barely shifted, yet the cash flow proved the strategy was still moving forward.

The system held. Yield engines kept paying, SOFI played its part, and the cash buffer grew stronger. No big trades, no reinvention, just steady reinforcement.

September brings its own set of risks with tariffs, inflation data and Fed signals all in play. The approach remains the same. Trade with patience, protect liquidity and step in only when the numbers line up.

💬 Let’s Talk

August reminded me how income can steady the ship even when prices drift lower. If you were in the same spot, would you keep leaning on yield engines like MSTY, ULTY and CONY, or shift more into broad ETFs for peace of mind?

Leave a comment