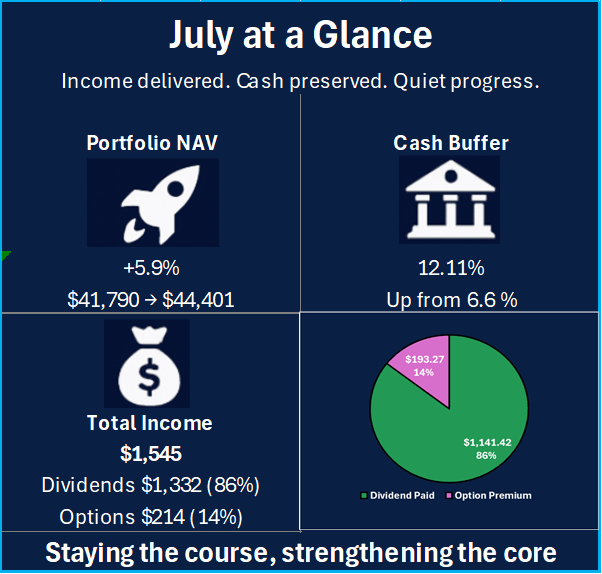

Growth +5.9%

Dividends $1,331.77

Option Income $213.61

Cash Reserve 12.11%

🖋️ Foreword

July appeared quiet on the surface, yet undercurrents were ever present.

On the surface, the numbers barely shifted. Underneath, the portfolio kept building. Dividends continued flowing in. Options stayed active. The cash reserve rose. There were no dramatic headlines, just steady reinforcement of the structure already in place.

SoFI tried to steal the spotlight with its swings and surprises. But the rest of the engine kept turning, steady and unfazed. This was a month defined by Patience, by pacing and knowing that sometimes inaction is the best course of action.

Let’s unpack it.

🖼️ Visual Summary

🔑Key Takeaways

- NAV Growth Continued

The portfolio grew by 5.9% in July. NAV rose from $41,790 to $44,401, supported by stable income flows and selective capital deployment. That said, the capital deposit of $3,136 resulted only in a growth of $2,611 due to weakness in prices. - Income Remained Steady and Balanced

July’s income totaled $1,545. Dividends made up $1,332 (86%), while options added $141 (14%). - Cash Position Strengthened

Cash reserves improved significantly. The reserve almost doubled from 6.6% in June to 12.11% by the end of July, creating more room for strategic flexibility. - MSTY Drove the Majority of Income

MSTY was the top income contributor for the month, paying $866.74. CONY followed with $278.29, and ULTY added $150.83 to the total. - SoFI Remained a Tactical Engine

SoFI’s price swings opened multiple entry and exit points for options. These moves generated a net premium of $214 through careful selling and early closeouts. - Portfolio Shifted Toward Higher Yield

Older positions in TIGR and QYLD were closed. The proceeds were then rotated into MSTY and ULTY, increasing exposure to higher yield assets with more predictable distributions.

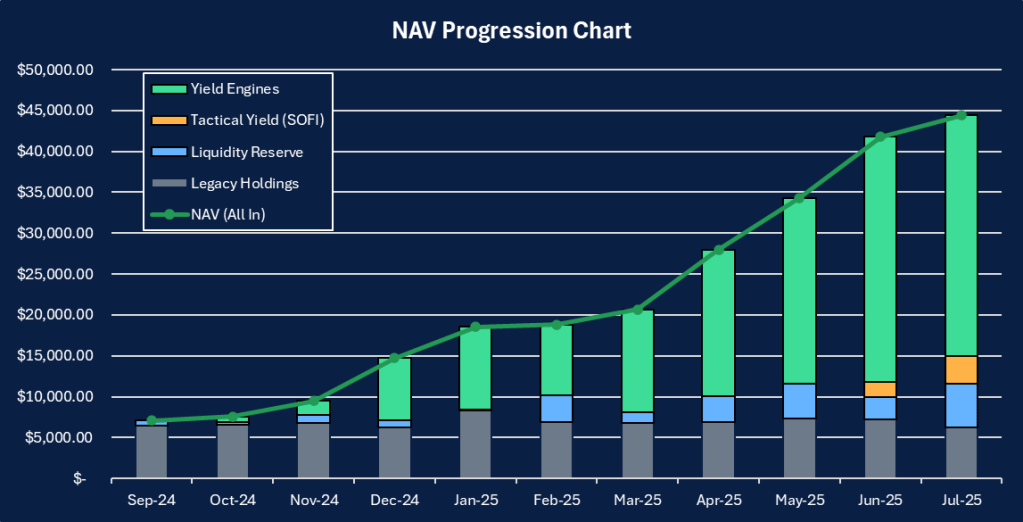

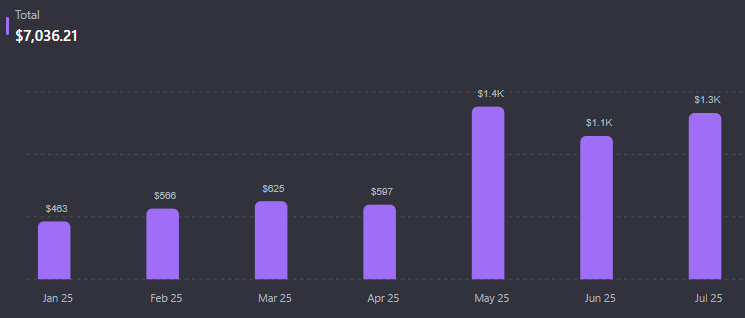

📊 NAV Progression

July closed with a portfolio NAV of $44,401, a quiet lift from June’s $41,790. No fireworks. No breakouts. Just the quiet removal of dead weight and gears falling in place.

Dividends and option income arrived without surprises. Housekeeping cleared out older names, bringing sharper focus. Cash climbed to 12.11%, giving the portfolio space to breathe and act when needed.

The Yield Engine felt pressure, especially across MSTY and CONY. But the softness there was offset by strength in SoFI and a few legacy names that held firm.

There was no defining moment, no standout trade. Just reinforcement being laid brick by brick.

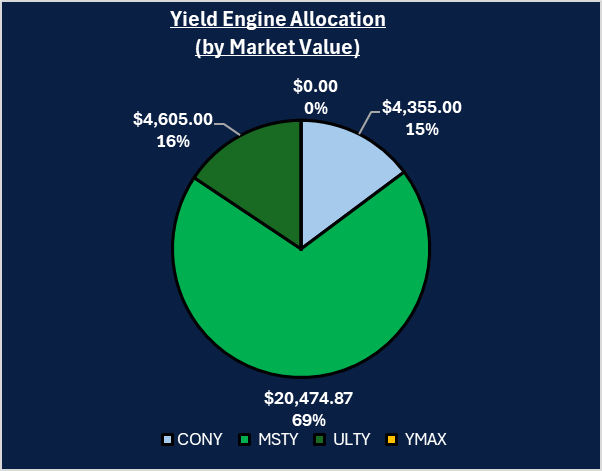

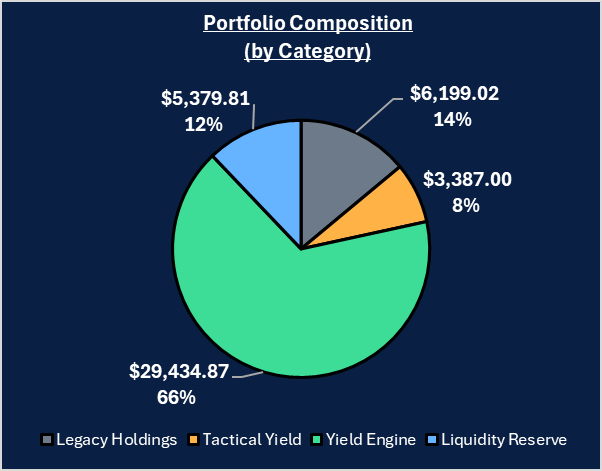

🧩Holdings

The portfolio breakdown held steady through July, with more than two-thirds of capital committed to the Yield Engine. MSTY remains the anchor within this category, with CONY and ULTY close behind. Scalability and repeatability continue to take priority over diversification for its own sake.

SoFI stayed in place as a Tactical Yield position. Though not paying dividends, it contributes through recurring cash-secured puts and opportunistic trades. With a weight just under 8% of NAV, it signifies cautious confidence, with space to expand if conditions stays favorable.

Legacy Holdings and the Cash Reserve made up the rest. These segments did not drive monthly returns, but anchored the portfolio and kept it flexible. They protected against over-extension and gave room for quiet adjustments, without rocking the boat.

Fresh capital of just over $3,100 was deployed during the month. This inflow, along with earned income helped lift NAV from $41,790 to $44,401, even as market volatility tested core holdings. The structure held and the direction stayed intact. July was a month for steady refinement, not reinvention.

🌐 Market Update

Volatility & Rates

What was expected

Volatility was expected to stay low. The VIX had been hovering around 13 to 15, and there was little reason to expect disruption. The Fed was widely expected to hold rates steady at the July meeting. Market sentiment was neutral. Inflation data mattered, but no one was bracing for surprises. Yield premiums were likely to stay stable, allowing for consistent option income without risk of assignment.

What happened

The first half of July went according to plan. The VIX lingered near 14 for weeks. But by late July, cracks had begun to show. The Federal Reserve kept rates unchanged on July 31, as the market expected. But Powell signaled caution, noting softer labor markets and cooling inflation. That message nudged the VIX above 18. Though it was not a spike, it was enough to change the tone in short-dated options.

How the portfolio responded

With volatility rising, premiums followed. SoFI and MSTY became more rewarding, giving better choices in strike prices and duration. The portfolio adapted without needing to overextend itself. Staying steady protecting the reserves built, while collecting what the market offered.

Crypto & Equity Performance

What was expected

Bitcoin was projected to hover between $105,000 and $110,000. Ethereum show little momentum and was expected to drift below $4,000. Most YieldMax tickers were expected to remain steady or dip slightly. SoFI’s earnings posed the biggest unknown, but overall, the market was expected to remain relatively stable.

What happened

Bitcoin broke through the ceiling. It climbed over 10% and reached $120,113 mid-month before pulling back slightly to end around $115,758. Ethereum moved less, but firm, trading between $3,626 and $3,807.

YieldMax equities, did not follow crypto higher.

- MSTY lost ground even as Bitcoin surged

- CONY struggled as bearish sentiment hung over Coinbase

- YMAX drifted lower with the broader market.

Then came SoFI. On July 29, it reported $815.5 million in revenue and EPS of $0.06. The climbed, briefly touching $23. But hours later, the company announced a $1.5 billion shelf offering. That sent the stock tumbling over 12% intraday before stabilizing towards the close.

How the portfolio responded

Most SoFI puts were closed ahead earnings, locking in premium and dodging the drop. MSTY and CONY distributed dividends as expected, but prices sagged. The crypto rally while strong, failed to lift the related equities. Even so, the portfolio stayed fully invested in core holdings and income still remained steady.

Outlook for August

Volatility is expected to remain elevated. The VIX will likely to hover between 17 to 20 shaped by the CPI and employment data. Option premiums should remain rich, but will demand more discipline in sizing and exit levels.

Bitcoin may retest the $120,000 zone, but consolidation is overdue. Ethereum lacks momentum and needs a strong push to break above current levels. YieldMax names will likely stay split. MSTY may benefit if Bitcoin stabilizes above $115,000. But CONY continues to be weighed down by sentiment and needs a bounce in Coinbase activity. SOFI will likely remains volatile but tradable, offering opportunities, if managed with care.

The path forward is clear. Stay patient, preserve liquidity, and avoid overexposure under pressure. The system is working. The goal now is not to trade more, but to trade better.

🎯Objective Review

Here’s how we performed against our July targets at a glance:

Base Goals

✅ Income Goal: Generate at least $1,000 — Exceeded

July produced $1,545 in total income. Dividends led at $1,332, bolstered by double CONY distributions and a full MSTY payout cycle. Options added $214, with SOFI CSPs contributing steady premiums throughout the month. The goal was not only reached but comfortably surpassed, without chasing risk.

✅️ Cash Reserve: Rebuild to a minimum of 8% — Met

Cash levels recovered to 12.11% of NAV by month-end. This was supported by disciplined reinvestment pacing and fresh capital inflow. No unnecessary trades were made. The portfolio reclaimed optionality, leaving space to act in August without pressure.

✅ Option Selling: Focus only if premium exceeds 2% — Met

SOFI remained the sole focus for option activity, and every CSP sold met or exceeded the 2% return threshold. Most positions were opened with less than 14 days to expiry and closed early once profits were captured. No trades were forced. All premiums aligned with plan.

Stretch Goals

✅ Total Income: Exceed $1,300 — Surpassed

The stretch goal called for $1,300 in income. The final figure of $1,603 cleared that mark decisively. Strong dividend contributions paired with disciplined SOFI premiums created a balanced and reliable stream. Income quality was not sacrificed for volume.

✅ NAV Growth: Add $2,000 to $3,000 — Met

NAV expanded by $2,611, finishing at $44,401. Gains were driven by consistent reinvestment and relatively stable market pricing in core holdings. ULTY, and SOFI accounted for the bulk of this growth. There was no windfall, only steady execution.

✅ Selective Reinvestment: Add ULTY or MSTY — Executed

A final week ULTY purchase was made after the cash reserve threshold was safely met. MSTY also received a minor addition earlier in the month. No other tickers were touched. The approach remained focused, and the rules were followed to the letter.

✅ Risk Discipline: One CSP max unless reserve exceeded — Met

At no point during the month did the portfolio hold more than one SOFI CSP at a time. Each trade was sized with care, and no exposure was doubled even during high IV spikes. Risk stayed manageable. Flexibility stayed intact.

📁Holdings

Core Income Holdings

- MSTY

Remained the backbone. Its monthly dividend was paid on time, and the underlying stayed firm through market churn. - CONY

Provided two dividend cycles this month, supporting cash flow despite modest price slippage. - ULTY

Received increased allocation after the YMAX exit. Its weekly dividends continued without disruption, offering smoother payout cadence. - YMAX (Fully Exited)

Fully exited in mid-July. Proceeds were recycled into ULTY at a more attractive yield and with clearer payout frequency.

Tactical Overlay

- SoFI

Multiple CSPs were executed and closed early, generating stable premium while avoiding unnecessary risk.

No shares were assigned, and all positions respected sizing discipline.

The stock moved sharply during earnings week, but the portfolio remained unaffected due to early closures.

Other Holdings

No changes were made to legacy holdings. Positions in names like BB, NVDA, PLTR, and global ETFs continue to serve as ballast and long-term exposure.

Liquidity Reserve

Cash reserves recovered meaningfully. After fresh deposits and limited reinvestment, the reserve rose back above the 10% mark.

🏦 Income Overview

July was the portfolio’s highest yielding month so far. The total income reached $1,603, carried by dividends and options execution.

Dividend Highlights ($1,332)

- MSTY led once again, its size and consistency doing the heavy lifting.

- CONY paid twice in the month of July, the 28 day cycle lined up, allowing this smaller position to pack a greater punch.

- ULTY, showed consistency, maintaining a stable payout during this quiet stretch.

- YMAX added a final contribution prior to the exit, with funds rotating into ULTY mid-month.

Option Activity ($214)

- All option trades in July came from SoFI

- A total of 5 short puts were written and subsequently closed for profit.

- Premiums were taken early, with no assignments or unnecessary exposure.

Yield Profile

- Overall Yield: 3.5 %

- Dividends: 3.0 %

- Options: 0.5 %

The income engine continued to remain consistent. This combination of reliable dividends from core holdings and flexible premiums from tactical overlays has proven to be a repeatable stream of income.

🔭 Next Steps

August will be a time to collect, not to chase. The income engines will continue to stay in place, however positioning will now be of utmost importance. With macro risks around tariffs and global tensions, the path forward calls for more restraint and care. MSTY, ULTY and CONY wiill remain the pillars, while SoFI will still be used as a tactical overlay. All this boils down to discipline, patience and precision.

Area of Focus

- Maintain Yield Flow

The Core Engine is working. Continue being allocated. No changes needed. - Refine SoFI Exposure

Continue put selling. Stick to short duration and size positions moderately. Avoid overexposure until volatility settles. - Prepare for August Swings

Tariff updates, inflation news and crypto’s next leg may all hit within the next few weeks. Prepare and map exit levels in advance and be prepared to take profit or add if required. - Keep the System Lean

Avoid diversification. Remove any position that no longer fits the income or optionality goals.

📅 Month 11 Objectives

✅ Base Target

- Income Goal:

Generate at least $1,000 in total income - Cash Reserve:

Maintain a cash reserve between 8 and 10% of NAV. - No New Equity Buys

Avoid equity purchases unless reserves exceeds 10% and the position enhances yield or stability. - Option Selling:

Focus on SOFI and MSTY only if premium exceeds 2.5% return on collateral with short exposure windows.

🚀 Stretch Goal

- Total Income:

Exceed $1,300, led by dividends and select SOFI CSPs - NAV Growth:

Grow total NAV by $2,000 to $3,000 through income accumulation and favorable price action across the portfolio. - Selective Reinvestment:

Consider adding to ULTY or MSTY if premiums are attractive and market structure holds. - Maintain Risk Discipline:

Limit to one active SoFI CSP unless cash reserve is above 10%

These objectives continue to prioritize sustainability over speed, balancing near-term income with long-term optionality.

🧠 Final Thoughts

July showed that even with capital deployed and dividends flowing, growth might still stagnate. That doesn’t mean that the plan is failing, it just means that the timing is not right yet. Yield continues to be harvested, positions held and liquidity preserved when it mattered.

August now seeks patience. The constant bombardment of headlines will tempt action. Price swings will trigger insecurities and will invite overreaction. But, the strategy remains clear. Income first. build flexibility and only act with clarity. Our journey is not measured in weeks, but in how well our rules hold when tested.

Stay focused, funded and let the quiet work continue.

💬 Let’s Talk

Where do you stand this month?

Did you stay the course or feel the urge to shift gears?

What are you watching most closely?

Drop your thoughts in the comments. I’d love to hear how others are balancing conviction and caution in this kind of market. Whether you’re stacking income, rotating sectors, or just sitting tight, there’s value in every approach when it’s intentional.

And if you’ve been following along for a while, thank you. Your feedback shapes how this portfolio evolves and how each post gets better.

Let’s keep the conversation going.

Leave a comment