🎯 Foreword

Ethereum is recovering toward $3,800 on solid footing, not just bouncing back. Unlike Bitcoin’s push to new highs, this rally reflects deeper currents, growing institutional demand, clearer regulation, and stronger technical structure.

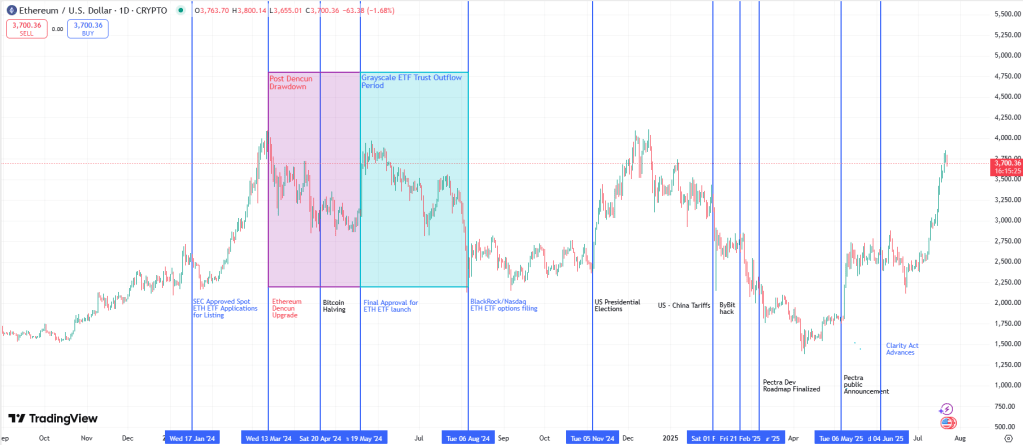

Key milestones highlighted:

| Date | Milestone |

|---|---|

| 17-Jan-2024 | SEC spot ETH ETF approval |

| 13-Mar-2024 | Ethereum Dencun upgrade |

| 20-Apr-2024 | Bitcoin halving |

| 19-May-2024 | Final SEC approval for ETH ETF launch |

| 06-Aug-2024 | BlackRock/Nasdaq ETH ETF options filing |

| 05-Nov-2024 | US presidential election |

| 01-Feb-2025 | US-China Tariffs begin |

| 21-Feb-2025 | Bybit hack (~$1.5B loss) |

| 06-May-2025 | Pectra upgrade announcement |

| 04-Jun-2025 | Clarity Act advances |

Why this matters?

Institutional allocators are steadily building ETH positions and policy clarity has reduced uncertainty. At the same time technical patterns and on-chain metrics are signalling a more sustainable recovery than the hype-driven swings of the past.

🏦 Institutional Flow and Regulatory Tailwinds

Institutional flows and policy shifts reveal whether this rally has real staying power or is just noise.

✅ Record ETF Inflows

On 11 Jun 2025, ETH spot ETFs drew $240 million, the biggest single-day haul in four months. That level of demand suggests allocators are building positions methodically, not chasing short-term dips.

✅ Policy Momentum

- Clarity Act advanced on 04 Jun 2025

- GENIUS Act passed later in June 2025

These milestones gave institutions the confidence to allocate to ETH’s DeFi and stablecoin infrastructure.

✅ Corporate Treasury Adoption

Several S&P 100 firms disclosed ETH holdings in Q2 2025. Small relative to BTC allocations, this signals a shift in perception, with ETH now viewed as programmable money suitable for treasury diversification.

With capital flowing in and regulation clarifying the path ahead, the next question is how Ethereum’s price structure is responding.

📈 Technical and On-Chain Signals

Technical patterns and on-chain activity tell us whether the recovery is solid or vulnerable to reversal.

✅ Constructive Price Pattern

A clear cup-and-handle has formed since the April low. Reclaiming the 100-day and 200-day averages suggests momentum is shifting back to buyers not sellers.

✅ Critical levels:

- Support Zone: $3,500 to $3,600

- Resistance Zone: $3,800 to $4,000

- Breakout Target: $4,200 to $4,300

✅ On-chain signals:

- Staking is rising, reducing available supply

- Exchange balances are falling as holders move ETH offline

- Large wallet activity suggests institutional accumulation

Each trend underlines that investors are choosing to hold not flip ETH.

💬 Let’s Talk

- How are you adjusting your ETH position now that price has reclaimed key levels?

- Which yield overlay will you focus on first to earn passive income as you build exposure?

I look forward to reading your thoughts in the comments below.

Leave a comment