🎯️ Foreword

In the last six months Circle’s CRCL has soared 509 percent, yet most investors have no clue why. Is USDC really reinventing money movement, or is the market riding a story? In this deep dive we strip away the noise to answer

- Why does CRCL command a $178 share price

- Can it justify that valuation

- What comes next

📚 Background

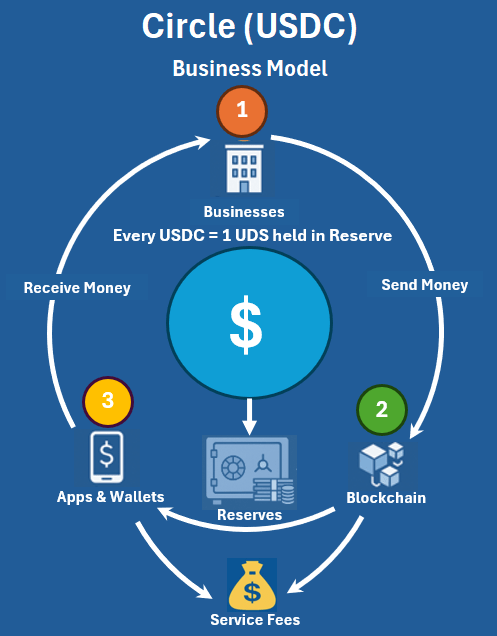

Circle issues USDC, a stablecoin pegged one-to-one to the US dollar and fully backed by cash and short-term assets. Businesses convert fiat into USDC to enable fast, low-cost transfers. Wallets and apps then hold and move USDC on blockchain networks.

Think of Circle as part bank, part payment network: it safeguards reserves like Citigroup and routes transactions like Mastercard. Circle earns fees each time it issues or moves USDC on chain. Those fees plus interest on reserves keep the peg intact and guarantee anyone can redeem one USDC for one US dollar.

⚙️ What Makes CRCL Tick?

📊 Valuations

| Metric | CRCL (Circle) | Citigroup (C) | Mastercard (MA) |

|---|---|---|---|

| Market Cap | $42 b | $165 b | $517 b |

| P / B | 56× | 0.85× | 77× |

| P / S | 22× | 3.2× | 18× |

| P / E | 2038.04 | 38× | 39× |

Valuations Takeaway:

CRCL’s 2,038× P/E dwarfs bank multiples by an order of magnitude, underscoring an almost unbridled growth premium on USDC adoption.

💰 Financial Resilience

| Metric | CRCL | Citigroup (C) | Mastercard (MA) |

|---|---|---|---|

| 2024 Revenue | $1.68 b | $81 b | $28 b |

| YoY Revenue ↑ | +58 % | +8.9 % | +12 % |

| 2024 Profit | $157 m | $12.7 b | $12.9 b |

| YoY Profit ↓ | –42 % | +37 % | +15 % |

| Reserves | $3.9 b | n/a | n/a |

| Quick Ratio | ~ 1.0 | n/a | n/a |

| Debt / Equity | 0.05 | 1.62× | 2.82× |

| Free Cash Flow | $95 m | – $25.9 b | $13.6 b |

Resilience Takeaway:

Rapid 58 % revenue growth contrasts with –42 % profit drop, showing reserve backing boosts trust but squeezes margins.

⚖️ Regulatory Exposure

| Risk Factor | Impact | Mitigation |

|---|---|---|

| Segregated reserves | Limits deployable cash | Broaden non-stablecoin services |

| Customer concentration | Revenue hit if a major partner pauses USDC usage | Onboard more mid-sized businesses |

| Legislation changes | Could raise reserve or capital requirements | Engage proactively with regulators |

Regulatory Takeaway:

Strict reserve rules and partner reliance cap capital flexibility and fee diversification.

🔍 Key Insights

Circle trades at eye-watering multiples because investors bet on rapid USDC adoption and fee growth rather than legacy finance returns.

Its 58 % revenue growth dwarfs peers, yet margins and free cash flow remain constrained by one-for-one reserve backing.

On the risk side, segregated reserves and partner concentration cap deployable capital and diversification.

These contrasts set the stage for our bear and bull case scenarios.

🐻 Bear / 🐂 Bull Case Scenarios

🐻 Bear Case

| Trigger | Impact |

|---|---|

| Regulatory clampdown | Higher reserve ratios or capital buffers cut into fee income and FCF |

| Major partner exit | Transaction volumes collapse, slashing fee revenue |

| Crypto market downturn | Large USDC redemptions strain reserves and raise “run-on-the-bank” risk |

| Valuation unwind | P / E reverts toward 100×, driving share price down to roughly $8.70 |

🐂 Bull Case

| Trigger | Impact |

|---|---|

| Strong USDC adoption and revenue growth | 50 % revenue rise lifts EPS by ~50 % |

| Stablecoin clarity | Continued institutional inflows boost fee margins |

| Crypto market rally | Greater on-chain activity increases transaction fees |

| Multiple holds steady | P / E remains near 2,038× to reward execution and low risk |

| Metric | Today | Bull Case Estimate |

|---|---|---|

| EPS (current) | $0.0873 | $0.0873 × 1.5 ≈ $0.131 |

| P / E multiple | 2 038× | ~2 038× |

| Implied share price | $178 | $0.131 × 2 038 ≈ $267 |

Bull math

New EPS ≈ $0.131 (50 % growth)

Price ≈ $0.131 × 2 038 ≈ $267

Bear and bull catalysts hinge on regulation, partnerships, market sentiment, and EPS growth rather than arbitrary multiple shifts. In the bear scenario, stricter reserve rules, partner exits, and a crypto downturn could force P / E back toward 100×, knocking CRCL to under $10. In the bull case, 50 % revenue (and EPS) growth, with the market maintaining its lofty 2 038× multiple, could lift the share price toward the mid-$200s. Mapping these triggers helps pinpoint when to scale in or trim your position.

🔮 Outlook & Speculations

In this section we forecast CRCL’s path over three horizons (short term, medium term, and long term) based on likely catalysts and market dynamics.

🕒 Short Term (1–3 months)

- Catalysts:

Q2 reserve audit, any SEC guidance on stablecoins, mid-sized partnership announcements - EPS / Growth Assumptions:

Assume 10 – 15 % revenue growth as transaction volume scales, EPS rising to $0.096 – $0.100 - Price Range:

- At the current 2,038× multiple: $196 – $205

- If the multiple contracts to 1 500×: $144 – $150

📈 Medium Term (3–9 months)

- Catalysts:

Broader USDC integration in remittance corridors, consumer wallet adoption, progress on stablecoin legislation - EPS / Revenue Impact:

Assume 30 – 40 % revenue growth, EPS rising to $0.114 – $0.122 - Price Range:

- At 2,038× multiple: $231 – $249

- If volatility cools and multiple contracts to 1 500×: $171 – $183

🌅 Long Term (9–18 months)

- Catalysts:

Full enactment of stablecoin law, tokenized deposit products from banks, expansion into Asia and Europe, broader DeFi adoption - EPS / Revenue Impact:

Potential 70 – 100% cumulative revenue growth, lifting EPS to $0.150 – $0.175 - Price Range:

- At a 2,000×+ multiple: $297 – $349

- Even under a 1,200× multiple: $180 – $210

🔍 Outlook Insights

In the short term, 10 – 15 % growth could lift price into the $196 – $205 range at today’s multiple, or into $144 – $150 if multiples compress. Over the medium term, 30 – 40 % growth points to $231 – $249 at 2 038×, or $171 – $183 at 1 500×. Long term, 70 – 100 % growth with sustained high multiples could push price toward $300+, while a conservative 1 200× valuation still places CRCL near $180–$210.

✨ Final Thoughts

Circle’s CRCL sits at the intersection of cutting-edge stablecoin innovation and traditional finance, trading at an extraordinary 2,038× P/E on just $0.0873 EPS. Near-term catalysts like audit clarity and regulatory guidance could lift price into the $196 – $205 range, while long-term adoption and legislative wins might push CRCL toward $300 or more. Yet strict reserve rules, partner concentration, and extreme multiples create real downside, with a bear-case reset to 100× pricing CRCL under $10.

🗣 Call to Action

What do you think?

Can CRCL justify its current valuation, or is a multiple reset inevitable?

Share your view in the comments below.

“Will Circle sustain a 2,000× P/E multiple, or is a reset inevitable?”

Leave a comment