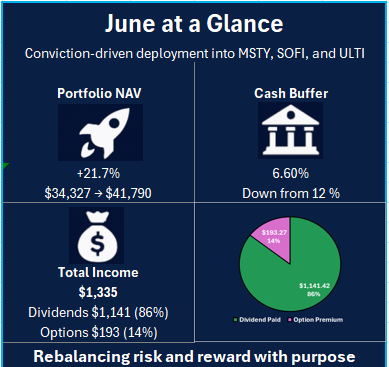

Growth +21.7%

Dividends $1,141.42

Option Income $193.27

Cash Buffer 6.6%

🖋️ Foreword

Following May’s sharp 22.5 percent NAV increase, June became a moment for reflection and repositioning. Rather than chase further momentum, I chose to rebalance and allocated over $7,500 into MSTY, SOFI, and a new income candidate, ULTY. Each allocation was made after careful consideration for yield sustainability, portfolio flexibility, and strategic alignment.

This decision came with trade-offs. The cash buffer narrowed to 6.6 percent, a deliberate shift in exchange for higher income potential. While MSTY continued to deliver consistent dividends and SOFI’s premiums contributed to the month’s inflows, headwinds from CONY and YMAX tempered overall returns. Still, total income reached $1,334.69, a reassuring sign that the core engine remains intact.

June was more about course correction and alignment than expansion. Each adjustment reinforced the goal of building a hybrid portfolio that balances dividend income with long-term growth. As July unfolds, the focus turns to managing liquidity, monitoring volatility, and staying anchored to strategy, especially when the temptation to overextend begins to surface.

🖼️ Visual Summary

🔑Key Takeaways

- Conviction Capital Deployment

Over $7,500 was deployed into MSTY, SOFI, and a new income holding, ULTY. These additions reflect increased confidence in sustainable yield engines while phasing out lower-conviction assets. - NAV Growth Maintained

Despite reduced liquidity, the portfolio posted a strong NAV gain of 21.7%, ending June at $41,790. - Income Stability Preserved

Total income for the month reached $1,334.69, with dividends accounting for $1,141.43 (86%) and options contributing $193.27 (14%). The mix of passive and tactical yield sources helped maintain dependable inflows. - Cash Buffer Compressed

The cash position narrowed to 6.6 percent, down from 12 percent in May. This heightens exposure to liquidity risk and limits flexibility entering Q3. - Mixed Core Performance

MSTY held firm. In contrast, CONY and YMAX continued to drag, with CONY now down over 33 percent from cost. - SOFI as a Tactical Yield Engine

SOFI, deployed for capital appreciation and premium harvesting, gained 11.1 percent and contributed $180.73 in options income. It continues to serve as a tactical growth and options overlay through cash-secured puts.

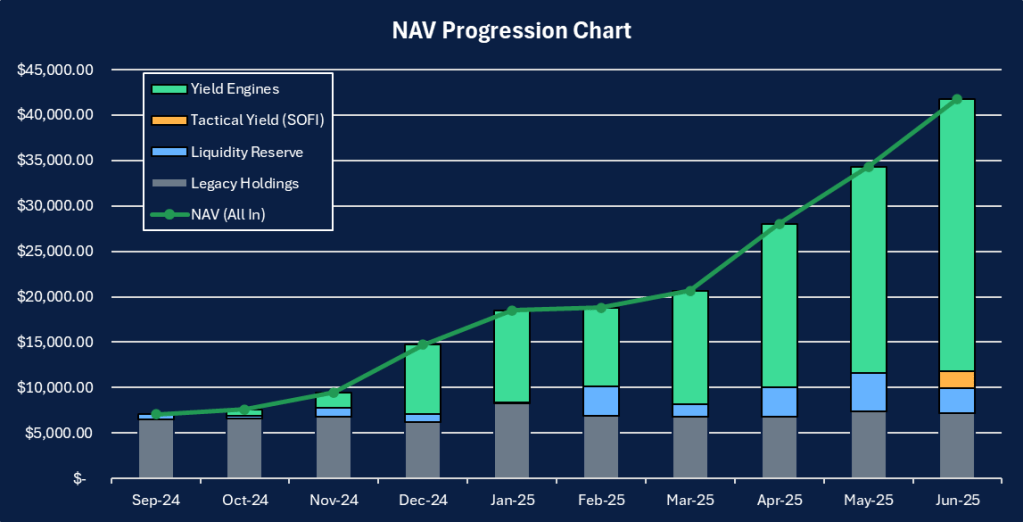

📊 NAV Progression

The portfolio rose from $34,338 to $41,790, a 21.7 percent increase driven largely by new capital allocation. Yield Engines like MSTY and ULTY continued to provide a dependable stream of income. SOFI, now separated as a tactical yield position, contributed meaningfully through both premium generation and price appreciation. The decline in liquidity to 6.6 percent reflects a conscious shift toward higher allocation and greater commitment. Legacy Holdings remain in the backdrop, serving as a reminder of where the portfolio began and how its focus has evolved over time.

🧩Holdings

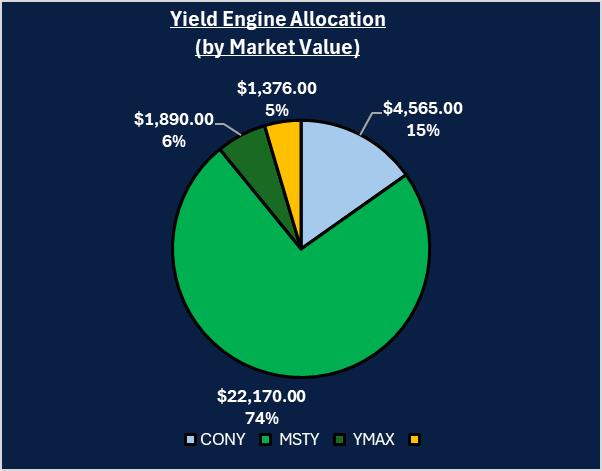

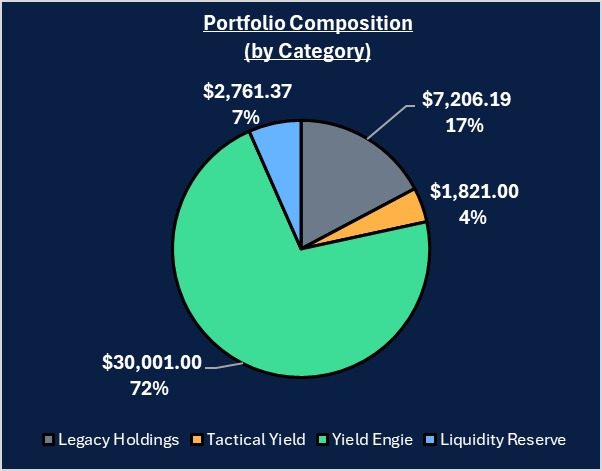

The portfolio remains deliberately concentrated, with over 70 percent of capital allocated to Yield Engines. MSTY dominates the category, representing nearly three-quarters of yield-generating capital, followed by CONY and YMAX. This reflects a continued emphasis on consistency and scale over diversification for its own sake.

SOFI is now classified separately as a Tactical Yield position. While not dividend-paying, it plays a strategic role through regular cash-secured put premiums and price movement potential. Its 4 percent weight signals both commitment and caution.

Legacy Holdings and Liquidity Reserve make up the rest, together contributing to flexibility and historical continuity. Their presence anchors the portfolio, offering flexibility while grounding newer strategic shifts.

🌐 Market Update

Volatility & Rates

- Forecast in May

VIX in the high teens, with a potential jump into the low 20s if CPI surprised. - Outcome in June

Volatility steadily escalated throughout the month. After starting June near 17.7, the VIX climbed consistently, breaching 20 mid-month and reaching a peak of 22.51 on June 23. By month-end, it closed even higher at 24.70. This fulfilled the projection and signaled a broader market unease, likely driven by macroeconomic jitters and upcoming earnings season expectations.

For the portfolio, this shift had two direct effects:- Option premiums widened, especially on SOFI cash-secured puts and select YieldMax tickers. This made it possible to collect 11 percent yield on capital from SOFI with relatively short exposure durations.

- However, rising volatility pressured NAVs across CONY and YMAX, both of which dipped modestly in price despite their high yields. This tested conviction in maintaining positions through short-term weakness.

- Option premiums widened, especially on SOFI cash-secured puts and select YieldMax tickers. This made it possible to collect 11 percent yield on capital from SOFI with relatively short exposure durations.

- July Outlook

Volatility is expected to remain elevated as earnings season begins and key inflation and labor data are released. The VIX could stay within the 20 to 25 range, maintaining elevated option pricing. While this environment supports continued options income generation, discipline becomes more important than ever.

Expect:- Richer premiums across mid-to-high IV tickers like SOFI, MSTY, and CONY

- Higher assignment risk and price swings

- Greater need to protect downside and preserve cash flexibility

- The key strategic takeaway: Use volatility to harvest yield, not to chase trades. Selective sizing, clear exit thresholds, and a preserved liquidity buffer (targeting at least 8 percent) will be essential for navigating July effectively.

Crypto & Equity Performance

- Forecast in May

Bitcoin was trading slightly above 104,000, with resistance between 108,000 and 110,000, and support near 100,000 to 102,000. - Outcome in June

Bitcoin tracked within expectations, oscillating between $102,000 and $111,000. After dipping to a monthly low of ~$101,000 on June 6, it rebounded and hit a high of $110,600 on June 11 before stabilizing around $107,000–$109,000. This validated the projected resistance-support channel and offered several tactical opportunities for entry and trimming, particularly for those pairing it with MicroStrategy exposure (MSTY).

Equities, especially YieldMax constituents, diverged meaningfully:- MSTY (MicroStrategy) remained resilient, supported by BTC strength, and continued to pay out robust monthly dividends.

- CONY (Coinbase) and YMAX lagged, weighed down by increasing volatility and market caution, even though option IVs remained elevated.

- Broader indices faced intermittent pressure, partially explaining why NAV growth in June came more from new capital deployment than organic asset appreciation.

- July Outlook

Crypto markets remain range-bound, but with positive skew. Bitcoin is consolidating just below resistance near $110,000, and a clean breakout could trigger rapid moves toward $115,000–$118,000. However, failure to hold above $106,000 could reopen the lower end of the channel near $102,000.

For equity-linked YieldMax names:- Expect more bifurcation — tickers tied to stronger narratives (MSTY, SOFI) will outperform others under macro pressure (CONY, YMAX).

- Monitor earnings from Coinbase and other crypto-adjacent firms, which could influence July NAV swings and implied volatility levels.

- Option income opportunities remain strong, but capital must be deployed selectively, with tighter stop levels and rollover readiness.

🎯Objective Review

Here’s how we performed against our June targets at a glance:

✅ Target NAV Growth of $2,000 to $3,000 — Exceeded

The portfolio rose by $7,452, far exceeding the target. This came primarily from fresh capital deployment into MSTY, SOFI, and ULTY. While organic price growth was limited due to market drag from YMAX and CONY, the strategic repositioning justified the strong NAV climb.

✅️ Income Target of $1,000 — Exceeded

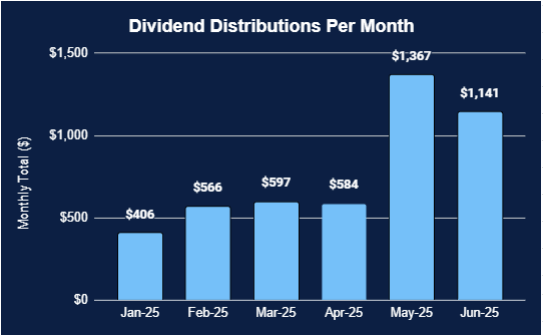

Total income for June reached $1,334.69, with $1,141.69 from dividends and $193 from option premiums. Income resilience remained intact despite reduced liquidity and market volatility.

❌️ Maintain Cash Buffer of 8 to 10 Percent — Missed

Cash buffer dropped to 6.6 percent, below the lower bound of the objective. The shortfall was a calculated trade-off to pursue higher income exposure through ULTY and additional SOFI allocation. The decision elevated income potential but reduced flexibility heading into Q3.

✅️ Avoid Overextension of Options Exposure — Met

Option activity remained conservative. All trades were kept small, with premium targets met through SOFI CSPs. No margin exposure or excessive rollovers were introduced. Risk-adjusted discipline was preserved.

📁Holdings

Core Income Holdings

- MSTY

Continued to serve as the primary income engine. Delivered $875 in dividends, stable NAV, and consistent volatility profile. Allocation was increased as a reflection of continued confidence in yield delivery. - YMAX

Yield contribution remained reliable, but price action was soft. The ETF’s tech-heavy exposure made it more sensitive to macro equity volatility. No further allocation was made in June. - CONY

Price weakness persisted, with a decline pushing unrealized losses beyond 33 percent. Despite elevated premiums, new exposure was avoided due to deteriorating risk-reward. - ULTY (New Addition)

Introduced in June as a new income position. Early contributions to monthly cash flow began immediately. Weekly covered calls are now being monitored for premium viability.

Tactical Overlay

- SOFI

Treated as a tactical growth and yield overlay. Delivered $193 in option income, with share price rising 11.1 percent. Position size and exposure were carefully managed to avoid overextension.

Other Holdings

Legacy non-yield assets were left untouched. These include older positions currently excluded from the yield strategy’s active tracking and income metrics. Visual separation has been applied in the allocation chart to distinguish these from primary positions.

🏦 Income Overview

June’s income stream remained resilient, supported primarily by dividends and tactically enhanced through options. Total income reached $1,334.69, with dividends making up $1,141.43 and options contributing $193.00.

Dividend Highlights

- MSTY continued to anchor portfolio cash flow, delivering $875, or roughly two-thirds of total dividends.

- CONY and YMAX maintained consistent yield flows despite market softness.

- ULTY, a new entrant, began contributing to income and is expected to strengthen its role in the coming months.

Option Activity

- SOFI, treated as a tactical yield position, gained 11.1% and was the primary contributor to $193 in option income, with additional premiums from CONY covered calls.

- No covered calls or high-risk rollouts were employed, preserving flexibility and reducing downside exposure.

Yield Profile

- Overall Yield: 3.7 percent

- Dividends: 3.2 percent

- Options: 0.5 percent

Despite a tighter cash position and rising volatility, the income engine remained consistent. The blend of reliable dividends from core holdings and flexible premiums from tactical overlays provided a balanced, repeatable return stream.

🔭 Next Steps

July will be less about acceleration and more about stability and positioning. With a compressed cash buffer and elevated volatility, every trade must now serve a clear purpose — either to enhance income efficiency or to reinforce strategic alignment.

Area of Focus

- Rebuild Liquidity

While June’s deployments were necessary, the reduced cash buffer limits flexibility. Targeting a rebuild toward 8 to 10 percent cash reserves is now essential. - Watchlist Reassessment

Continue to monitor ULTY, MSTY, and SOFI for additional opportunities. However, further exposure to CONY or YMAX will require a decisive reversal in price momentum or premium expansion beyond historical averages. - Avoid Forced Trades

Trading discipline will remain a priority, with capital committed only when clear setups align with strategic intent. - Macro Sensitivity

With earnings season and potential rate signals on the horizon, remain sensitive to macro catalysts. Expect sudden shifts in IV and equity sentiment.

This phase is about measured execution, trading only when it adds meaningful value to income, flexibility, or conviction.

📅 Month 10 Objectives

✅ Base Target

- Income Goal:

Generate at least $1,000 in total income - Cash Buffer:

Rebuild to a minimum of 8 percent of NAV - No New Equity Buys

unless buffer exceeds 10 percent - Option Selling:

Focus on SOFI and MSTY only if premium exceeds 2 percent return on collateral

🚀 Stretch Goal

- Total Income:

Exceed $1,300, led by dividends and select SOFI CSPs - NAV Growth:

Add $2,000 to $3,000 to total NAV through income and market positioning - Selective Reinvestment:

Consider adding to ULTY or MSTY if premiums align and price action stabilizes - Maintain Risk Discipline:

All trades must preserve flexibility, with no more than 1 CSP active at a time unless cash exceeds target buffer

These objectives continue to prioritize sustainability over speed, balancing near-term income with long-term optionality.

🧠 Final Thoughts

June offered a reminder that progress does not always come from acceleration. Sometimes, the most strategic decisions are those that slow us down just enough to realign.

The portfolio grew meaningfully, but not from windfall trades or market luck. The gains came from deliberate allocation, consistent yield harvesting, and a steady hand amid rising volatility. ULTY was added not as a bet, but as a step toward reinforcing income stability. MSTY remained the core. SOFI proved its place as a tactical overlay. Even setbacks like CONY’s continued drawdown provided clarity on what should no longer be chased.

July brings with it uncertainty, but also opportunity. The cash buffer is thinner than ideal. The market is jumpier than it has been in months. But the engine is intact. The focus now shifts to pacing — rebuilding liquidity, protecting downside, and letting income work without overextension.

If June was about course correction, then July is about maintaining altitude.

💬 Let’s Talk

Which of your holdings did the heavy lifting in June?

Did you add any new positions, or are you holding back until volatility cools?

Drop your thoughts in the comments. I’d love to hear how others are balancing conviction and caution in this kind of market. Whether you’re stacking income, rotating sectors, or just sitting tight, there’s value in every approach when it’s intentional.

And if you’ve been following along for a while, thank you. Your feedback shapes how this portfolio evolves and how each post gets better.

Let’s keep the conversation going.

Leave a comment