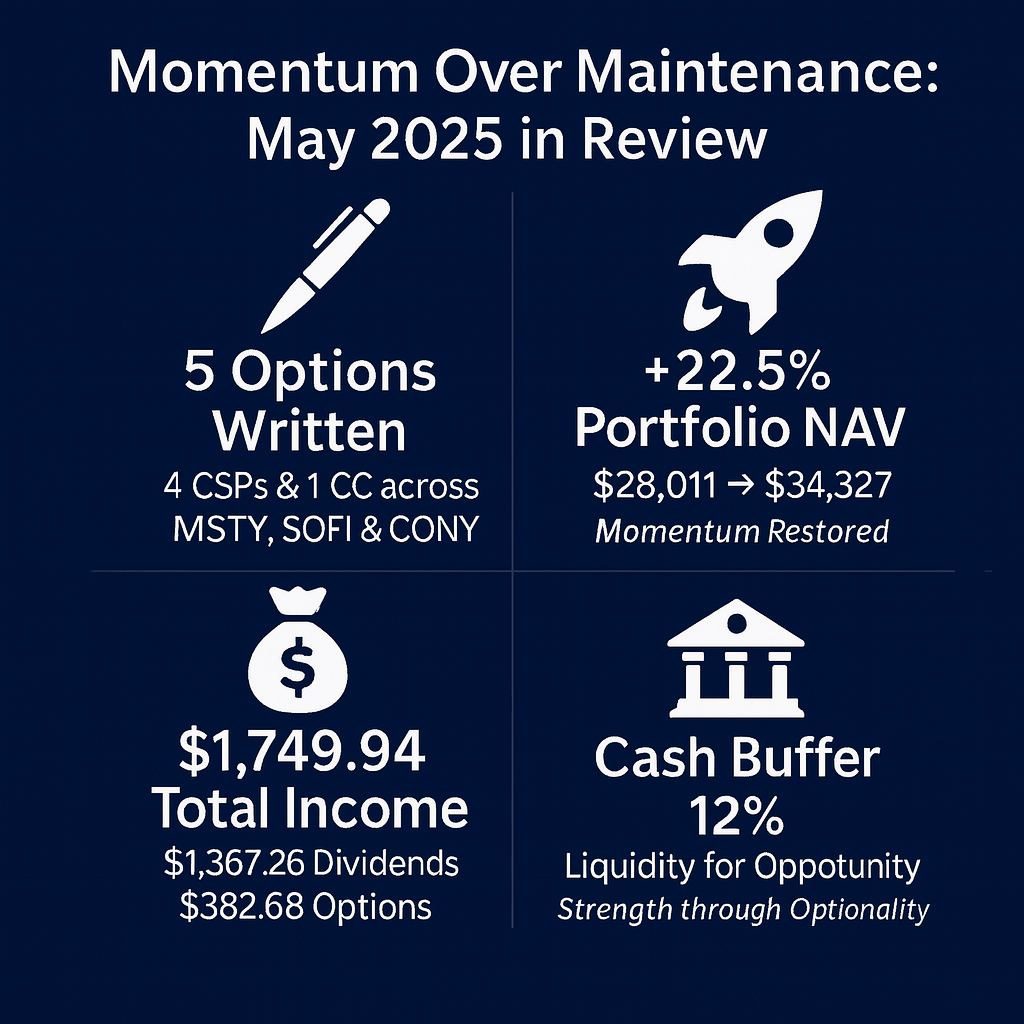

Growth 22.5%

Dividends $1,367.26

Option Income $382.68

Cash Buffer 12%

📖 Foreword

In May 2025 our portfolio delivered a 22.5 percent NAV gain, driven by $382.68 in option premiums (a 4.7 percent yield on collateral) and an 11.1 percent Bitcoin rally. The cash buffer expanded to 12 percent, providing flexibility to pursue high conviction income trades. In this report we unpack the key performance drivers and outline our strategic plan for the month ahead.

🖼️ Visual Snapshot

🔑Key Takeaways

- NAV Growth: Up 22.5 percent, rising from $28,011 to $34,327

- Option Income: $382.68 collected, yielding 4.7 percent on collateral (1.4 percent on NAV)

- Dividend Income: $1,367.26 received, equating to a 4.9 percent yield

- Combined Yield: Total income reached 6.3 percent for May

- Crypto & Volatility: Bitcoin rallied 11.1 percent while VIX fell from 23.94 to 18.57

- Cash Buffer: Expanded to 12 percent of portfolio, enhancing optionality

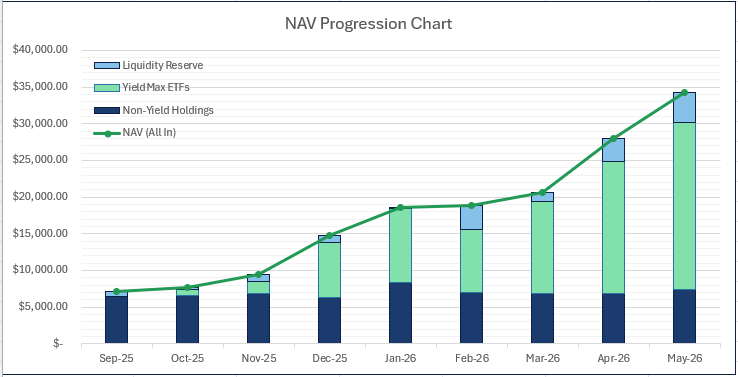

📊 NAV Progression

In May our NAV climbed from $28 011 to $34 327, a 22.5 percent increase. Cash rose from $3 207 to $4 207, while core income ETFs and satellite equities together contributed the remaining $6 109 of growth. This jump was powered by elevated option premiums, dividend income and a strong crypto rally.

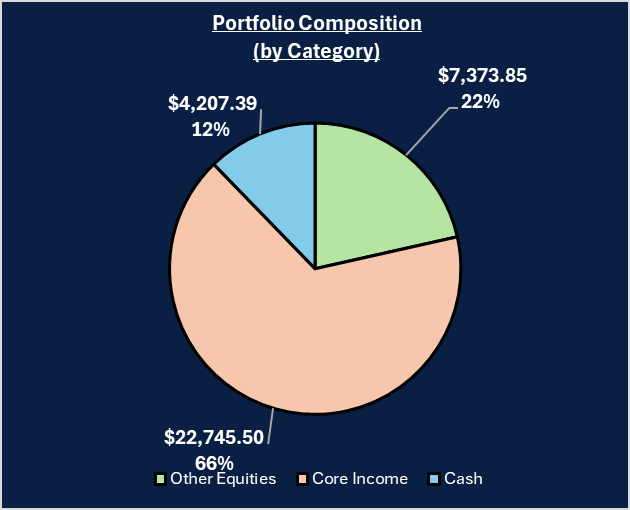

🧩 Portfolio Composition

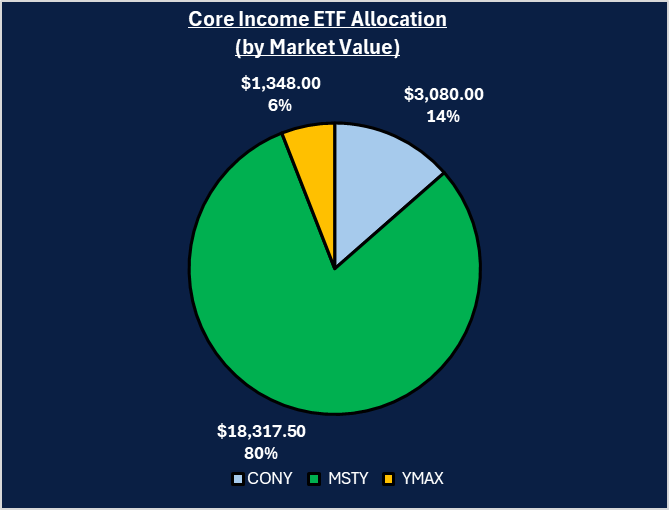

- Core Income ETF Mix: MSTY dominates at 80%, CONY holds 14% and YMAX 6%

- Overall Portfolio: Core income ETFs account for 66%, satellite equities 22% and cash 12%

- The tilt toward MSTY reflects our focus on high-IV option premiums, while satellite equities provide growth ballast

🏦 Core Income Review

Option Activity

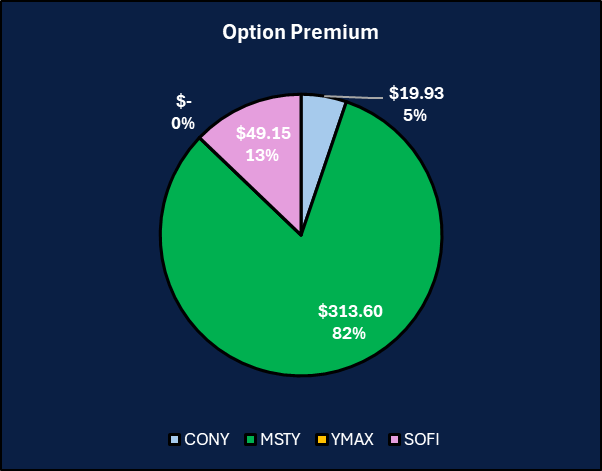

In May we wrote four cash-secured puts and one covered call, collecting $382.68 in net premiums. Measured against the $8 100 of total collateral posted for these puts, this delivered a 4.7 percent yield on collateral (and a 1.4 percent yield on NAV). We’ll unpack the detailed trade-by-trade breakdown and collateral usage later in this section.

We added SOFI to our watchlist and sold the 13.00 put because its post-earnings IV spiked above 50% and its balance sheet supports a low risk of assignment.

Income Activity

Dividends once again powered our income engine, generating $1,367.26 and delivering a 4.9 percent yield on core positions. Combined with option premiums, total income yield for May reached 6.3 percent. Detailed dividend contribution by ticker follows below.

🌐 Market Update

Volatility & Rates

- Fed commentary remained “patient” on further rate hikes, supporting yield-sensitive assets

- The VIX fell from 23.94 to 18.57, signaling easing equity market fear

Crypto & Equity Performance

- Bitcoin rallied 11.1 percent, climbing from $94 169.39 to $104 638.09 in May

- MicroStrategy (MSTR) shares slipped 5.9 percent while MSTY dipped 4.3 percent

Forecast & Projections

- Volatility:

With VIX hovering in the high teens, option premiums should stay elevated. A surprise in upcoming CPI data could push VIX back toward the low-20s - Crypto Momentum:

Bitcoin now sits just above $104 000. Watch resistance at $108 000–$110 000 and support near $100 000–$102 000 for potential entry/exit triggers - YieldMax ETFs:

Implied volatility across CONY, MSTY and YMAX remains richer than broader equity indices. We expect continued opportunity to write cash-secured puts and covered calls at strikes 5–10 percent out-of-the-money, targeting 2.5 percent premium income per month depending on IV levels and available collateral

🎯 Objective Review

Here’s how we performed against our May targets at a glance:

✅ Rebuild Cash Buffer — Carry Over

Our goal was to maintain a cash buffer above 11 percent of NAV. In May we exceeded this target, lifting the cash buffer to 12 percent. This extra liquidity reinforces optionality, allowing us to patiently wait for compelling equity or option opportunities without fear of being undercapitalized.

⚠️ Reassess Underperformers — Active

We set out to monitor YMAX for further weakness and to hold CONY if it showed stability. YMAX remained structurally weak but we chose not to trim, instead opting to observe for a clearer breakdown. CONY delivered minor signs of recovery, validating our decision to maintain the position for another month.

⚠️ Stay Selective With Options — Watchlist Active

The plan was to sell cash-secured puts or covered calls only when weekly premiums exceeded 2.5 percent of collateral. All four MSTY puts and the single CONY call achieved yields between 3.7 percent and 5.3 percent, comfortably surpassing our threshold and confirming the effectiveness of our watchlist discipline.

⚠️ Monitor BTC–MSTY–MSTR Correlation — Ongoing

We aimed to see whether MSTY and MSTR would move in step with Bitcoin without fresh capital injections. While Bitcoin rallied 11.1 percent, MSTY and MSTR both declined (–4.3 percent and –5.9 percent respectively), suggesting some decoupling remains. We’ll continue to assess this relationship before reallocating further.

✅ Income Target $400+ — Exceeded

We updated our dividend income framework to a $500 base goal with a $1,000 stretch target in high-volatility months. In May we collected $382.68 in option premiums and $1,367.26 in dividends, for a combined $1,749.94. This performance surpasses both the new base and stretch goals. We will review these thresholds quarterly.

✅ Stretch Goal — Targeted SOFI Entry via CSPs

We planned to write SOFI cash-secured puts once IV exceeded 45 percent and weekly premiums topped 2.5 percent of collateral. In May we sold one SOFI 13 put, earning a 3.7 percent yield while keeping the cash buffer above 10 percent. This stretch goal checklist was fully met.

📘 Next Steps

Lessons & Strategy Rationale

- Concentrated Option Income Works

Focusing on MSTY when its implied volatility spiked delivered outsized premiums. Writing three MSTY puts at varying strikes captured higher yields than diversifying across lower-IV ETFs. - Cash Buffer Is Optionality

Maintaining 12 percent cash proved valuable. It allowed us to avoid forced trades and wait for premiums that met our criteria. Liquidity grants the power to pick and choose higher-conviction opportunities. - Satellite Equities Smooth Returns

Adding and holding non-income equities like PLTR and other satellites contributed 7.8 percent of growth. This diversification helped offset drawdowns in CONY and MSTY’s NAV during market weakness. - Income Framework Needs Flexibility

The dual-tier $500-$1,000 goal aligns with market regimes. May’s strong performance hit the stretch target, but a $500 base ensures discipline when volatility normalizes.

📅 Month 8 Objectives

As we head into June, our overarching strategy is to build on May’s strong momentum while maintaining disciplined risk management and liquidity. We will prioritise high-conviction option trades when premiums justify the collateral, protect our cash buffer to preserve optionality, and continue blending steady dividend income with targeted crypto accumulation. This balanced approach aims to drive incremental NAV growth without compromising flexibility.

- NAV Growth

Aim for a 3 percent to 5 percent increase, moving NAV from $34 327 toward $35 300–$36 000 - Option Premiums

Collect at least $200 in net premiums, targeting a 4.5 percent to 5 percent yield on collateral - Dividend Income

Generate $1,000 in dividends (≈3.6 percent yield on core holdings cost) - Cash Buffer

Maintain between 8–10 percent of NAV (≈$2,750–$3,430)

🧠 Final Thoughts

As we move into June, the foundation laid in May puts us in a position of strength. Our dual‐tier income framework and reinforced cash buffer allow us to be both opportunistic and disciplined. Elevated volatility still offers rich option premiums, while steady dividends and crypto momentum underpin NAV growth. By adhering to our targets and staying vigilant on market signals, especially VIX levels and BTC–ETF correlations, we can capture upside without overcommitting capital. Here’s to carrying forward this momentum with clarity and confidence.

💬 Let’s Talk

Drop your thoughts in the comments.

Let’s refine the playbook together — one trade, one lesson, one honest review at a time.

Leave a comment