📖 Foreword

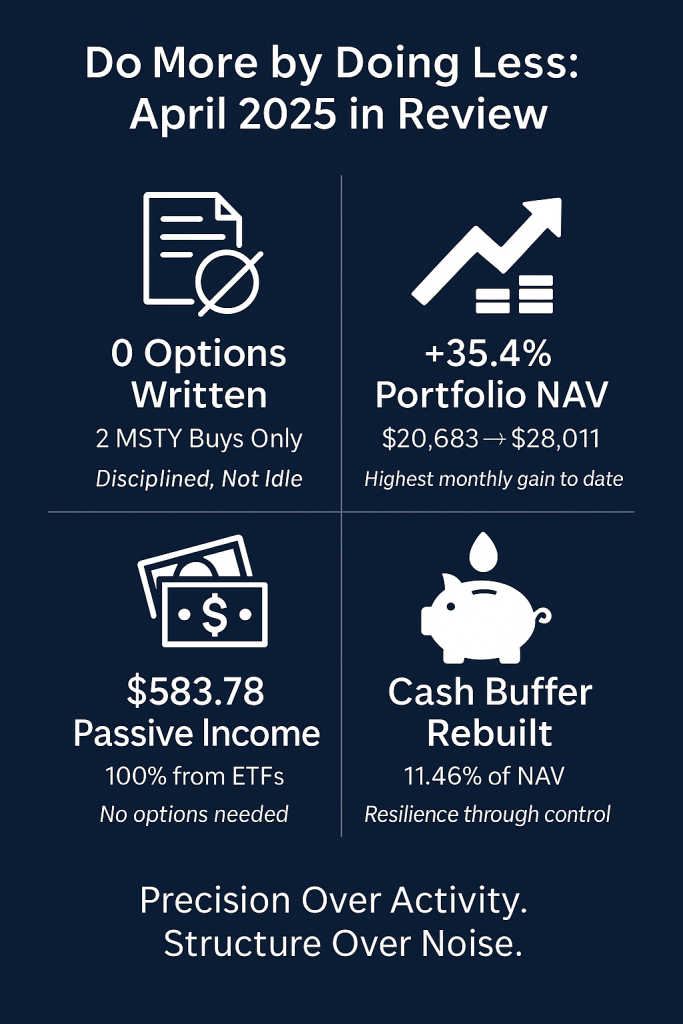

April 2025 portfolio review kicked off with the strongest NAV gain since inception in September 2024.

The portfolio rebounded 35.4%, rising from $20,683.07 to $28,011.26, proof that disciplined timing and core positioning paid off.

Option Activity

No options were written once again. Implied volatility crept higher, yet premiums across the YieldMax suite still failed to justify re-entry. The bar held.

Income Activity

Dividends did the heavy lifting. The portfolio collected $583.78 in passive income, matching March’s total and proving that the yield engine remains intact even in the absence of option flow.

Key take-aways from April

- This wasn’t a flashy month.

- It was a functional one.

- Capital grew. Income held.

- The portfolio,is beginning to lean forward again.

🎯 Objective Review

Here’s how we performed against our April targets at a glance:

✅ Rebuild Cash Buffer — Achieved

April began with $1,334.87 in cash and closed at $3,209.31, lifting liquidity to 11.46% of NAV, surpassing the 10% target. This rebound was especially notable considering the $3,245.79 deployed across two staggered MSTY buys: 50 shares at $19.50 on April 7 and 100 shares at $22.70 on April 24. Liquidity was not restored through idleness. It was rebuilt through deliberate pacing, steady dividend inflows, and disciplined capital deployment.

⚠️ Reassess Underperformers — In Progress

YMAX and CONY remain in the spotlight. YMAX continued its capital decline with minimal dividend support. CONY, however, showed early signs of stabilization, but not enough to remove its watchlist status. No exits were made, but deeper evaluation has begun. The decision window is narrowing.

⚠️ Stay Selective With Options — Deferred

No covered calls or cash-secured puts were executed in April, including on SOFI. Despite elevated VIX levels (rising from 22.06 to 24.70), actual premiums across core holdings (MSTY, CONY and YMAX) remained below the 2.5% threshold required for entry. The strategy of restraint continued. No trades were forced. The bar held firm.

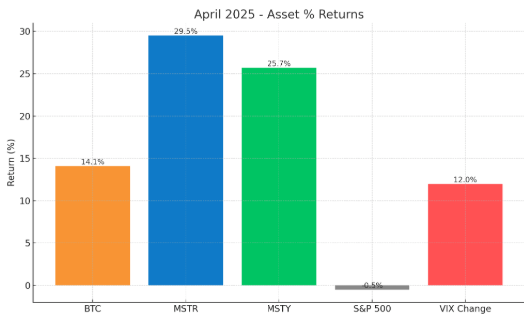

⚠️ Monitor BTC–MSTY Correlation — Mixed

Bitcoin rallied 14.1% in April, signaling renewed strength across the crypto sector. MSTY tracked reasonably well, rising 25.7%. This was a sign of improving structural responsiveness. However, the move was aided heavily by fresh capital infusion rather than pure NAV expansion. While MSTY’s NAV did trend upward alongside its proxy, MicroStrategy (+29.5%), the need for continued vigilance remains. Responsiveness has improved but is not yet consistent.

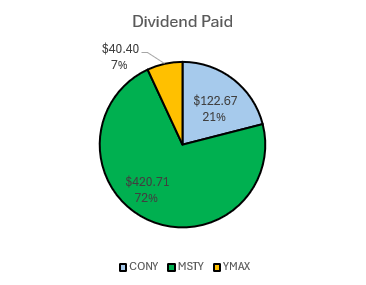

✅ Income Target $400+ — Exceeded

Total income reached $583.78, entirely from dividends. No CSPs or calls contributed meaningfully to income, yet the portfolio cleared its monthly goal with margin. This affirms the strength of the dividend engine, even as the premium environment stays muted.

📌 Summary

April was a re-centering. Liquidity returned. Income held.

Trades were sparse but intentional. Underperformers were left untouched, but not ignored. The portfolio enters May with optionality intact and a structure geared for resilience over reach.

📊 Market Update

- Equities Recap:

- S&P 500 returned -0.5% in April

- Market breadth remained narrow

- Large-cap tech continued to hold up, but cyclicals softened.

- Crypto Sector

- Bitcoin surged +14.1%, It’s strongest month since January.

- MicroStrategy rose +29.5%., restoring correlation strength

- MSTY followed with a +25.7% rebound

- Volatility Signals

- VIX rose from 22.06 to 24.70

- Implied volatility increased across the board

- However, premiums across MSTY / CONY / YMAX did not propotionately expand.

- Interpretation

- Volatility returned, but income opportunities stayed limited.

- Strong crypto gains did not spill over into option yield recovery

- A silent test of conviction rather than a trading bonanza.

🏦 Core Income Review

April delivered a powerful rebound across the portfolio’s income-generating base. Core holdings ( MSTY, CONY, and YMAX) appreciated from $12,536.00 to $17,959.00, marking a +43.3% portfolio-level surge. This growth was driven primarily by MSTY’s explosive performance, with more muted contributions from the rest.

MSTY was the undisputed growth engine. Two well-timed buys expanded the holding from 400 to 550 shares. The result was a $5,255.00 increase in value, eclipsing the gains from all other components combined.

CONY showed marginal improvement, reversing some of its prior decline, but remains under close watch due to fragile capital structure and volatility sensitivity.

YMAX once again faltered. The ETF lost ground on both yield and value. Its continued weakness raises serious questions about long-term role in the income sleeve.

Yet despite the imbalance, dividend income from core income ETFs held steady at $583.78, matching March’s total. A testament to income durability even as capital values diverged.

🚀 Growth Holdings

April brought a quieter month for non-YieldMax positions. These equities, often held for asymmetric upside or strategic diversification, contributed modestly to overall NAV growth. The aggregate value rose from $6,812.20 to $6,842.95, a marginal gain of $30.75 (+0.5%).

This steady line reflected the absence of major moves or new capital deployments in these holdings. Unlike the explosive returns from MSTY, the satellite group served more as ballast, providing portfolio breadth but little in terms of direct performance lift.

No trades were executed within this segment during April. The lack of movement was intentional. With market breadth narrowing and option premiums staying muted, the satellite sleeve was left untouched to preserve flexibility.

No capital growth or speculative holdings were active this month. Portfolio remained focused on income generation and liquidity preservation.

💰 Income Performance

April extended the portfolio’s income momentum, delivering a total of $583.78 in passive income, identical to March’s total. Despite the absence of option trades, income held steady, supported entirely by ETF dividends.

This outcome once again reinforces the durability of income flows, even during months with reduced market activity or fewer tactical moves. The portfolio’s structural emphasis on high-yield instruments (e.g., CONY, MSTY, YMAX) once again proved its reliability in funding passive growth.

Highlights

- No covered calls or cash-secured puts were executed during April.

- The YieldMax suite remained the primary engine for dividend income.

- Income met the portfolio’s recurring $400/month target, reaffirming its baseline strength.

Despite limited activity, income remained stable and entirely unassisted by derivatives. A reflection of both careful ETF selection and a structurally sound income foundation.

📊 Income Composition

- MSTY: $420.71 (72%)

- CONY: $122.67 (21%)

- YMAX: $40.40 (7%)

📘 Next Steps

April reinforced a vital truth often forgotten in high-churn markets: patience, discipline, and structural integrity outperform urgency.

Key Lessons:

- Income Engine is Robust

$583.78 was achieved with zero options deployed. The passive income base is sustainable,even in muted markets. - Selective Action Outperforms Forced Trades

With MSTY buys carefully paced and no CSPs forced, the portfolio grew without stress-testing liquidity. Every trade had purpose. - NAV Expansion Can Be Decoupled from Activity

Despite minimal trading, NAV grew 35.4%. The core holdings did the heavy lifting. - Correlations Require Ongoing Monitoring

MSTY’s tracking of MSTR and BTC improved, but was aided by fresh capital. This calls for continued diligence, not complacency. - Underperformance Needs Structure, Not Emotion

YMAX was left untouched, and rightly so. No rash exits. But it remains a problem child in need of decisive criteria.

Looking Ahead to May:

- Structure Holds Priority

There is no rush to deploy. Cash remains above 10%, affording flexibility. - Re-evaluate Watchlist Holdings

YMAX and CONY remain under review. Decide: hold with conditions or trim. - Monitor Premiums

A VIX above 24.7 should bring opportunity. But entries will only occur if return thresholds exceed 2.5%. - Optionality Overreach

Let conviction trades emerge naturally. MSTY remains the engine, but new positions must earn their entry.

📅 Month 8 Objectives

May builds on regained footing. With liquidity restored and NAV sharply higher, the focus now shifts from repair to readiness. No urgency to act, but conditions call for active observation and agile response.

- Preserve Cash Buffer — Carry Over

Liquidity now sits above 11% of NAV. This must be protected. No new equity buys unless value emerges or options justify entry. Capital is optionality. Optionality is strength. - Reassess Underperformers — Active

YMAX remains structurally weak. No changes yet, but further decline may trigger a trim. CONY showed flickers of recovery. Another stable month may justify a hold. - Stay Selective With Options — Watchlist Active

IV is back, but still uneven. Monitor MSTY and CONY for premiums exceeding 2.5% of collateral. Strike only when reward-to-risk sharply favors entry. - Monitor BTC–MSTY–MSTR Correlation — Ongoing

Last month restored some alignment, but attribution came partly from capital injection. May must confirm whether structural responsiveness holds even without fresh buys. - Target Income: $400 Minimum — Maintain

The $400/month baseline remains unchanged. April hit $583.78 with zero trades. Let the ETFs work. But be ready to supplement with CSPs if volatility improves. - Stretch Goal — Targeted SOFI Entry via CSPs

Commence SOFI option activity if the following conditions are met:- Implied Volatility (IV) > 45% driven by earnings anticipation or sector rotation

- Premium exceeds 2.5% of collateral per week

- Strike price aligns with conviction buy zone (i.e., below $14.00)

- Cash buffer remains above 10% post-trade

🧠 Final Thoughts

April was proof that sometimes, less truly is more.

With only two equity buys and zero options sold, the portfolio grew nearly 36%. Not by chasing volatility, but by respecting it. The rebound was driven by MSTY’s recovery, BTC momentum, and a disciplined approach to capital deployment. Even as the VIX climbed and market breadth thinned, the portfolio stood its ground.

The lesson? You don’t always need action to see progress.

Cash reserves were rebuilt. NAV broke above $28K for the first time. Income exceeded target. And no positions were trimmed or forced. The machine didn’t just hold. It strengthened.

That said, fragility remains. CONY and YMAX continue to underperform. BTC-MSTY correlation must still be monitored. And income remains heavily reliant on a few levers. This is not the time for complacency. It is the time for calibration.

Month 8 sets the stage. Not for expansion — but for evolution.

💬 Let’s Talk

April asked for patience. Now it’s your turn to share:

- Have you ever had a month where inaction outperformed activity? What did you learn from it?

- With YieldMax ETFs delivering uneven results, how do you manage laggards? Do you trim, hold, or rotate?

- Is cash your safety net or a wasted opportunity in this environment?

- If you could only keep one ETF through the next quarter, which would it be, and why?

Drop your thoughts in the comments.

Let’s refine the playbook together — one trade, one lesson, one honest review at a time.

Leave a comment