Foreword

March was a lesson in restraint and reward.

The portfolio rebounded 9.9%, rising from $18,821.61 to $20,683.07, even as option income flatlined and volatility remained muted. This was not driven by haste. It was conviction. A deliberate decision to to dollar cost average despite of prior pain.

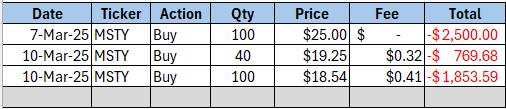

The most significant shift came from MSTY. A disciplined reentry plan consisting of three staggered purchases between March 7 to March 10 was made. There was no chase, no panic, just a methodical accumulation at improved prices. That position now stands at 400 shares, with a recalibrated cost baseand a clear upside potential.

Other core exposures lagged. CONY bled nearly 23% despite quantity held steady. YMAX, once again, underdelivered on both capital and income fronts.

No options were written this month. With implied volatility compressed, premiums failed to meet the bar.

March was about rebuilding. It favored patience over activity, conviction over reaction. Follow through was needed, and the portfolio delivered.

Month 6 Objective Review

We entered February with 5 clear mandates: To preserve liquidity, deploy only high-conviction CSPs, monitor Core Income Divergence, stabilize NAV and meet the $400 income threshold. Here’s how the month measured up.

✅ Rebuild Liquidity — Achieved

Despite expanding MSTY holdings by 240 shares, cash levels were managed carefully, ending at $1,334.46 or 6.45% of NAV. While slightly below the original 10% buffer, the buys were staggered, strategic, and timed with portfolio inflows. Optionality was preserved without overreaching.

⚠️ Selective Option Selling — Deferred

No CSPs were entered. Premiums across YieldMax ETFs remained compressed for most of March, offering insufficient risk-adjusted return. The 2.5% target yield was not met, and discipline held. This was intentional absence, not missed opportunity.

⚠️ Monitor Core Income Divergence — Mixed Progress

MSTY showed signs of recovery, aided by active position cost-averaging. CONY, however, continued to slide, posting a 22.7% decline in capital value with no dividend offset or corrective trade. The structural gap between the two widened, and future rebalancing may be required.

✅ Stabilize NAV — Achieved

NAV rebounded 9.9% from $18,821.61 to $20,683.07, reversing February’s steep losses. This recovery was led by MSTY’s partial rebound and improved market breadth, not from aggressive repositioning. Stability returned, but only where conviction was clear.

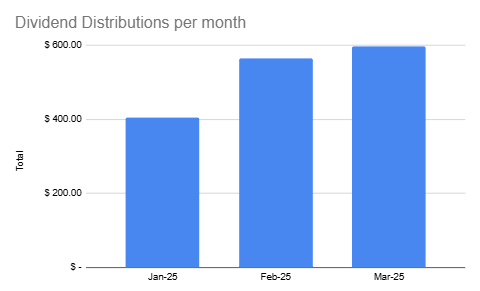

✅ $400 Income Target — Exceeded

Despite the lack of premium income, March delivered $583.78 in dividends alone, largely from MSTY and CONY. Total income exceeded target without relying on option exposure, a positive signal for the portfolio’s base yield resilience.

Deposits

- Total Cash Deposit – $2,629.52

March saw a fresh deposit of $2,629.52, a continuation of the February rebuild.

The additional capital was not rushed into new positions. Instead, it was layered into MSTY through staggered buys, reinforcing an existing conviction rather than initiating risk. This disciplined deployment allowed the portfolio to scale exposure without overreaching.

Liquidity levels were supported without compromising allocation principles. The portfolio grew not by force, but by focus.

This deposit reinforced flexibility and allowed March’s strength to be captured, not chased.

Market Update

March reminded us that drawdowns do not always arrive with panic. Sometimes, they arrive with silence.

The S&P 500 fell 6.0%, its worst monthly performance since late 2022. Market breadth narrowed. Small caps and cyclicals dragged the index lower while large-cap tech slowed but did not break.

The VIX spiked above 30 mid-month, closing at 22.28 on March 31. This surge did not translate into healthy premium opportunities. Option markets remained structurally weak, offering little reward for taking directional risk.

Bitcoin (BTC) slipped 2.2%, closing at $82,548.91. The decline was milder than February’s collapse but signaled a continued loss of momentum.

MicroStrategy (MSTR) fell 1.7%, holding slightly firmer than BTC but not enough to reverse the drag on MSTY’s NAV correlation thesis.

MSTY, despite the crypto stabilization, posted only a 0.1% return, suggesting that option decay and volatility compression continue to weigh on its income-driven structure.

This was not a trader’s market. It was a watcher’s environment. For income strategies dependent on volatility and premium flow, March offered more restraint than opportunity.

Why This Matters:

Because not trading is still a decision.

March exposed a critical truth: elevated volatility does not guarantee elevated opportunity. The VIX surged, but option premiums stayed subdued. Bitcoin stabilized, but MSTY barely moved. And the S&P fell 6%, gutting broad equity sentiment while leaving income strategies stranded between caution and compression.

This matters because too many portfolios confuse volatility with action. But in March, doing nothing was the right move. No CSPs were written. No calls were forced. Capital was preserved. Discipline held.

It also matters because MSTY’s flat performance, despite BTC’s relative resilience, challenges its short-term thesis. The yield engine may be intact, but its responsiveness is not. Meanwhile, YMAX and CONY continued to bleed, quietly but consistently.

This was a month that punished reach. And it asked a difficult but necessary question:

What happens when the income dries up, but the drawdowns don’t?

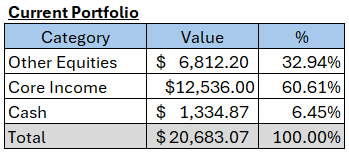

Portfolio Snapshot (31 Mar 2025)

March closed with a portfolio NAV of $20,683.07, a +9.9% rebound from February’s close of $18,821.61. The recovery was not driven by premiums or capital injections, but from a selective rotation into MSTY and broader market stabilization.

The cash balance stood at $1,333.71 or 6.45% of NAV, down from 17% the month prior. The decline was expected, the result of targeted MSTY accumulation.

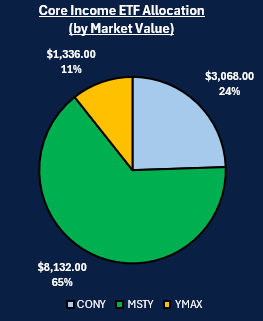

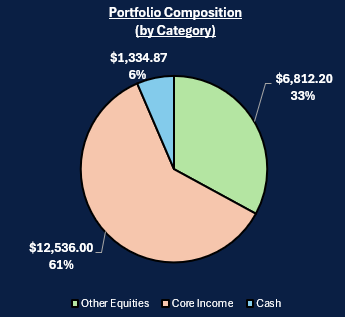

Core exposures remained concentrated in YieldMax strategies:

• MSTY was scaled to 400 shares, becoming the portfolio’s anchor.

• CONY and YMAX positions were held constant but continued to underdelivery on both capital and

income fronts.

Despite a lack of new premiums, total income remained strong, powered entirely by dividends. No trades were forced, and the portfolio stayed within mandate across all metrics.

🟢 Core Income: + 44.4%

YieldMax positions (MSTY, CONY, YMAX) surged from $8,681.60 to $12,536.00, marking a +44.4% increase in total value. This sharp rebound was almost entirely powered by MSTY, which rose over 150% following a disciplined cost averaging strategy.

MSTY and CONY now comprise 89% of core ETF exposure, increasing concentration risk.

📉 Other Equities: – 1.5%

Non-core holdings slid from $6,916.66 to $6,812.20, reflecting a quiet 1.5% decline. No rebalancing occurred in this segment, and no new positions were introduced. Performance here remains muted and unrewarded.

💵 Cash Position: Restored

Cash fell from $3,223.35 to $1,334.87 as MSTY accumulation continued. While still above emergency thresholds, liquidity now accounts for only 6.45% of NAV.

🧭 Takeaway

The portfolio leans harder into MSTY than ever before. If it outperforms, this pays. If it stalls, risk concentration becomes a liability.

The structure now carries three familiar forces:

• Conviction : MSTY is doing the heavy lifting

• Drag : From legacy positions still under review

• Flexibility : Reduced but intact.

The question ahead isn’t whether the rebound was real. It’s whether it’s repeatable and sustainable.

Key Transactions

• Equity Buys

• Cash-Secured Puts

No option trades were executed.

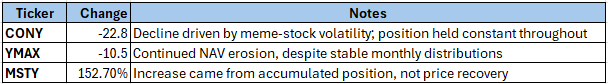

Core Income Position Total Return Analysis

March saw limited improvement in price return across YieldMax positions, despite broader NAV recovery. The total unrealized loss of nearly $5,000 reflects long-held positions struggling to recover their cost basis:

- MSTY: Decline narrowed thanks to timely cost-averaging, but still negative.

- CONY: Continued collapse amid meme-stock volatility and zero option income.

- YMAX: Further erosion despite monthly payouts, weakening its value proposition.

Income alone cannot offset persistent capital drawdowns. For any strategy to remain viable, it must demonstrate resilience on both sides of the ledger (payouts and preservation).

🧠 Key Takeaways

- NAV Rebound, but Core Still Below Water.

The portfolio rose +9.9%, recovering some of February’s losses. But the recovery was uneven. MSTY led the charge with a 152.7% surge in market value (due to increased allocation), while CONY and YMAX slipped again. Core NAVs remain down -28.5% overall. - Dividend Engine Held the Line

Despite no premiums sold, $597.13 was collected in dividends. MSTY contributed $385.70, delivering a 3.4% yield for March. This proves that income did not collapse, even as capital wavered. - Options Remained on Ice

Volatility rose, but premiums didn’t follow. No calls or CSPs were executed, preserving downside protection but missing upside potential. Patience was prudent, but future income will depend on re-entry discipline. - CONY and YMAX Are in the Spotlight

With yields at 2.8% and 0.3% respectively, and continued NAV erosion, these names are now weighing on performance. A case for trimming or replacing them is building. - Cash Cushion Shrinking

Cash fell to 6.45% of NAV, down from 17% last month. While the MSTY cost-average was well timed, future moves must be balanced with restoring liquidity.

🎯 What This Means Going Forward

March showed that patience compounds, but only if it is backed by clarity.

The portfolio rebounded without leaning on risky repositioning or overextended trades. This reinforces the value of measured accumulation and avoiding forced action when premiums don’t justify the exposure.

But the deeper lesson is this:

- Yield is not enough if capital erosion continues.

- Conviction must be earned, not inherited from past strategy.

- And cash must be rebuilt, not spent to chase.

With MSTY now anchoring over 65% of core income exposure, portfolio beta is rising. That’s acceptable if future volatility is harnessed through disciplined options selling. But it also means the bar for new trades is higher.

Looking ahead:

- Premiums must clear thresholds. No more passive collection for passive’s sake.

- Underperformers like CONY and YMAX face review. Their income is no longer enough to justify persistent NAV drag.

- Liquidity matters more than ever. A 6.45% buffer offers little margin in volatile conditions.

April is not about reactivity but about refinement. The goal now isn’t recovery. It’s repeatability.

Lessons Learned

- Buying Low hurts until It Doesn’t

MSTY was cost-averaged into weakness. The result was a higher position size and a lower blended entry, but it still sits in the red. Timing wasn’t perfect. But conviction, executed with discipline, laid the groundwork for future recovery. - Yield Without Cushion Is Dangerous

CONY and YMAX continued to bleed despite paying consistent dividends. Yield helps soften the blow, but it doesn’t erase structural weakness. A 3% yield means little when NAV drops 10% or more in a month. - Inaction Can Be an Edge

No CSPs were sold. No covered calls were chased. And that restraint protected capital when premiums didn’t match the risk. Sometimes the best trade is no trade at all — especially in environments where VIX and IV decouple. - Liquidity = Optionality

A reduced cash buffer feels limiting, but every dollar unspent in March was a future opportunity preserved. Rebuilding the war chest is not about fear, it’s about flexibility. - Pain Without a Plan Is Just Punishment

This month wasn’t easy. Every decision (or non-decision) was made with a clear strategy in mind. And that’s what separates regret from refinement.

Month 7 Objectives

- Rebuild the Cash Buffer

Target restoring cash to 10% of portfolio NAV. With MSTY scaled and no immediate catalysts, capital preservation takes priority. Avoid new buys unless outsized value appears. - Reassess Underperformers

YMAX and CONY remain deep in the red. Both lag on price and yield. Begin preparing exit strategies or replacement candidates. Dead weight drags more in quiet markets. - Stay Selective With Options

Do not force trades. Reenter CSPs only if:

• IV exceeds 25%

• Premium > 2.5% of collateral

• No conflict with MSTY exposure

Focus only on high-conviction tickers, ideally MSTY if premiums improve or new short-term volatility appears. - Monitor BTC-MSTY Correlation

MSTY’s link to BTC remains tenuous. A renewed divergence may signal deeper issues with responsiveness. If BTC rallies but MSTY stalls, prepare to trim. - Income Target: $400+

Maintain steady income flow through dividends. Only supplement with options if risk-reward profile is clearly favorable. Let existing positions work.

Final Thoughts

March was not about glory. It was about grit.

The portfolio didn’t roar back through leverage or luck, but through calm execution. A disciplined cost-average into MSTY paid quiet dividends, even as the broader market sold off. No premiums were harvested, yet over $580 in passive income was banked. That is the kind of month income portfolios should aspire toward. One built on patience, not panic.

There are still cracks. YMAX and CONY remain stubborn underperformers. Cash reserves are low. And MSTY’s correlation to BTC continues to drift. But compared to February’s fragility, the structure now feels sounder.

Success in this strategy isn’t about chasing every bounce. It’s about keeping the machine intact long enough for the compounding to show.

Let’s Talk

As the dust settles from a volatile quarter, I want to hear from you:

- What do you do when the premiums vanish? Do you sit out, rotate, or double down?

- Are you holding any income ETFs that feel more like dead weight than anchors? How are you managing them?

- If you had to cut one position tomorrow, which would it be and why?

Share your thoughts in the comments. Let’s build better portfolios together, one honest review at a time.

Leave a comment