Foreword

February demanded discipline at every turn. The portfolio’s NAV plunged 14.3%, falling from $18,527.26 to $15,878.81. A $2,942.80 cash infusion lifted headline NAV to $18,821.61 (+1.6%), but the optics of growth masked the truth: that asset performance was decisively negative.

Losses were broad, but especially sharp in high-volatility strategies:

• Bitcoin : Dropped $102,405 to $84,373 (-17.6%), derailing MSTY’s leveraged correlation thesis.

• YieldMax NAV declines across the board reflected growing pressure on underlying equities.

• MSTY : $17.16 to $14.84 (-13.5%).

• CONY : $13.00 to $9.93(-23.6%).

• YMAX : $16.17 to $14.92 (-7.7%).

CONY was gutted by meme stock dislocation, MSTY buckled under Microstrategy’s beta risk. Even YMAX, the portfolio’s ballast, failed to provide cover.

This month was a stress test, and the lesson is clear. Capital contributions can mask drawdowns, but they can’t fix bad positioning. YieldMax income comes with equity exposure, and February made the cost of that exposure brutally clear.

Month 5 Objective Review

We entered February with 4 non-negotiable targets. Liquidity, disciplined puts, metric overhaul and a $400 income goal. Here’s the harsh truth on each:

✅ Rebuild Liquidity – Met

February ended with $3,223.35 in cash, representing 17% of the total portfolio value, up from the near-zero in January. Liquidity was not just restored, it was fortified. A small purchase of 50 MSTY shares was executed as a controlled reallocation, not a breach of mandate.

This cash buffer restores optionality, a critical edge when volatility spikes or opportunity knocks.

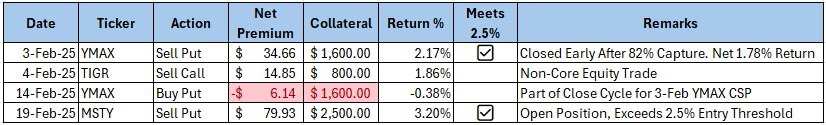

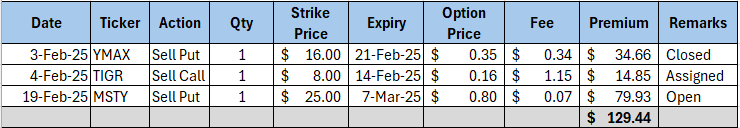

⚠️ Disciplined Puts – Mostly Achieved.

Cash Secured Puts (CSPs) were deployed selectively and aligned with the portfolio’s 2.00% premium threshold. Two trades were executed on core income funds:

• YMAX CSP (Feb 3): Closed early at 82% premium capture, delivering a net 1.78% return.

• MSTY CSP (Feb 19): Remains open, entered at 3.20% return, well above target.

Total net premium collected: $108.45, excluding TIGR, which is classified as a non-core equity and included for completeness only.

The discipline was sound. Execution was tight. But realized returns proved vulnerable to early exits and premium decay. As such, the CSP entry threshold will be raised from 2.00% to 2.50%, targeting a minimum 1.75% net return after partial premium capture.

Fewer. Cleaner. Better.

🔍BTC – MSTR Divergence – No Action Taken

The thesis entering February was clear. If Bitcoin rallied without confirmation from MSTR, MSTY exposure would be trimmed. What happened instead was worse. BTC collapsed, and MSTR collapsed harder.

• Bitcoin : $102,405 → $84,373 (-17.6%)

• MSTR (proxy): Underperformed even relative to BTC’s drop (-17.6%)

• MSTY NAV : Down 13.5%, with no bounce on BTC’s brief rebounds

The divergence thesis was confirmed, yet no positions were trimmed.

Whether due to hesitation, attachment bias, or unwillingness to crystallize losses, the inaction speaks louder than any signal. The result was a compounded drawdown, with MSTY dragging the portfolio deeper just as its structural link to BTC broke down.

Sometimes the hardest trades are exits. February showed that knowing when to sell is just as vital as knowing when to stay out.

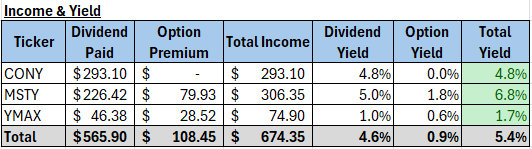

✅ Income Target $400 – Exceeded

The portfolio set a February income target of $400. Actual results came in well above expectations, with $674.35 in total income (68% outperformance). This includes:

• Dividends: $565.90

• Option Premiums: $108.45

• Total Income: $674.35

MSTY led the pack with a 6.8% blended yield, proving the case for selective CSP deployment. CONY offered a high baseline dividend without option activity, while YMAX trailed on both fronts—raising questions about its longer-term role.

This wasn’t just a win. It was a proof point. YieldMax funds, when timed and structured correctly, can deliver powerful cash flow even during capital drawdowns. The challenge now is to preserve the income engine without bleeding NAV in the process.

Deposits

- Total Cash Deposit – $2,942.80

A total of $2,942.80 was deposited in February. This was not a rescue. It was a rearmament.

The deposit restored cash levels to 17% of total NAV, reversing the near-zero balance seen in January. It was timed deliberately, not to chase trades, but to rebuild optionality after weeks of constrained flexibility.

This move unlocked strategic breathing room, enabling controlled trades like the MSTY CSP and positioning for future volatility spikes.

Discipline doesn’t always mean standing still. In February, it meant reloading without overreaching.

Market Update

February’s surface-level stability masked deeper structural cracks.

The S&P 500 fell 1.0% for the month, despite closing sharply higher on February 28 as investors shrugged off a heated exchange between Trump and Zelensky. Market breadth improved, but large caps continued to dominate gains, masking deterioration underneath.

In crypto, the damage was more direct. Bitcoin plunged 17.6%, falling from $102,405 to $84,373 as ETF momentum stalled and macro sentiment weakened. MicroStrategy lagged even further, intensifying the drag on MSTY and decoupling from BTC entirely.

The VIX declined modestly, opening at 20.36 and closing at 19.63. But this drop in headline volatility did not translate into premium expansion. Instead, implied volatility across YieldMax ETFs remained muted, choking off option yields just as NAVs declined.

This month was a grind down. For income-driven portfolios, February showed that capital can erode even when vol stays elevated, if the structure stops paying.

Why This Matters:

Because income without control is just exposure.

February wasn’t catastrophic. It was revealing. The portfolio delivered over $674 in income, but at the cost of double-digit NAV decline. Yields held up, but capital didn’t. And that breaks the unspoken rule of income investing: payouts must never outrun resilience.

The problem wasn’t just market direction, it was structural fragility:

• Volatility compression killed premiums right when drawdowns hit.

• Correlation breakdowns (BTC vs MSTR, meme stock reversals) exposed overconcentration risk.

• And strategy drift, surfaced in moments of hesitation, not action.

This month mattered because it asked a hard question:

Can the portfolio survive multiple months like this and still compound?

If the answer isn’t a confident yes, then the structure needs rethinking. The good news? Liquidity was restored. Trade discipline mostly held. And the income engine still runs.

Now it needs armor.

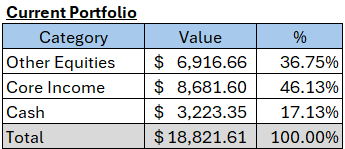

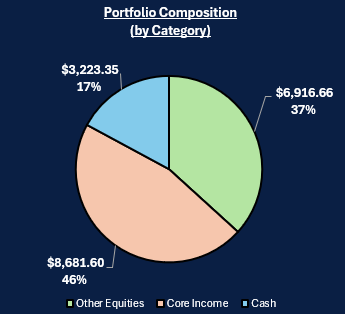

Portfolio Snapshot (28 Feb 2025)

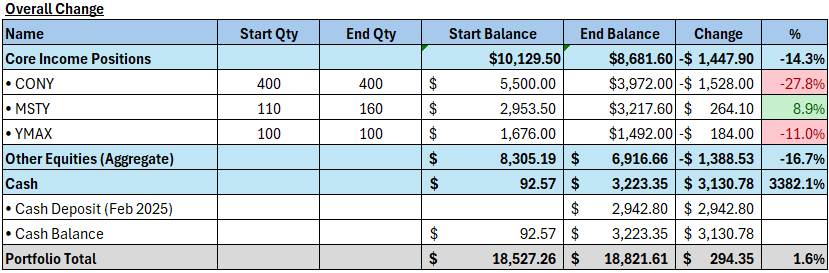

As of February 29, 2025, the portfolio stood at $18,821.61, up 1.6% from January’s close. That increase was entirely funded by a $2,942.80 cash deposit. Without it, performance would have shown a net loss, making February a month of erosion disguised as growth.

🔻 Core Income: – 14.3%

The YieldMax suite (CONY, MSTY, and YMAX) fell from $10,129.50 to $8,681.60, a drawdown of 14.3%. This erosion came despite regular income distributions.

MSTY and CONY now comprise 83% of core ETF exposure, increasing concentration risk.

📉 Other Equities: – 16.7%

Non-core holdings declined from $8,305.19 to $6,916.66, losing 16.7% in value. No trades were executed in this category during February. The drawdown reflects passive exposure to underperforming names without offsetting premium collection.

💵 Cash Position: Restored

Cash rose from $92.57 to $3,223.35, solely due to the February capital injection. This lifted cash to 17% of total NAV, restoring flexibility after January’s liquidity choke.

Core income remains the portfolio’s anchor, but cash has returned as a meaningful third pillar.

Takeaway

The income engine delivered, but the cost was clear. NAV decay was systemic, not isolated. With nearly half the portfolio tied to YieldMax ETFs, the structural risks became visible.

The current allocation offers three things:

• Yield : From income ETFs

• Liquidity : In the form of cash

• Drag : from unadjusted equity exposure

With liquidity restored, the question is no longer “what can be done?” but “what should be cut?”

Key Transactions

• Equity Buys

• Cash-Secured Puts

Note

• No new CSPs were written on speculative equities.

• TIGR trade excluded from core analysis due to non-core classification.

• Transactions were sparse, preserving liquidity and avoiding overreach during volatility compression.

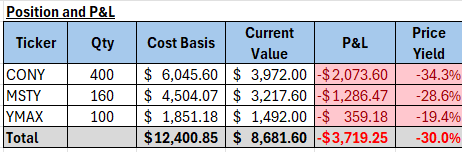

Core Income Position Total Return Analysis

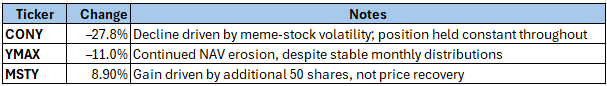

Cash flow matters. But capital preservation matters more. The portfolio’s three YieldMax positions (CONY, MSTY, and YMAX) continue to generate income, but the cumulative price damage now exposes a deeper truth. negative compounding is alive and well.

🧠 Key Takeaways

• Yield ≠ Return: All three ETFs have paid monthly distributions, but none have preserved capital.

• CONY delivered the worst absolute and % loss, offsetting any advantage from higher dividend yield.

• MSTY remains more defendable due to CSPs, but its underlying beta exposure remains a risk.

• YMAX appears most stable. But even here, a nearly 20% draw shows there is no “safe” income play

when volatility compresses.

Still, income didn’t flinch. Dividends across CONY, MSTY and YMAX delivered $405.71, hitting the Month 4 income goal.

🎯 What This Means Going Forward

The Core Income engine is under review. Income is still flowing, but the price yield is compounding against performance. This is not a call to panic, but it is a clear signal that position sizing, rotation, and entry levels must evolve.

Lessons Learned

February didn’t break the portfolio. It revealed its blind spots.

- Yield Can Mask Fragility.

Income was strong. On paper, everything worked. But capital bleed told a different story. High payouts distracted from underlying decay. Going forward, total return, not distribution size, will drive conviction. - Premium ≠ Protection.

Volatility compression quietly killed the premium engine. Even when the VIX hovered near 20, implied vol on YieldMax ETFs stayed muted. This mismatch exposed positions to decay without offsetting income, a structural flaw to monitor in quiet markets. - Correlation is Not a Covenant.

MSTY and CONY both decoupled from their underlying narratives. Bitcoin’s fall hurt MSTY, but MicroStrategy underperformed even further, breaking the leveraged beta thesis. CONY’s meme beta failed to rebound. In both cases, thesis erosion wasn’t met with timely trimming. - Liquidity = Optionality

The February cash deposit didn’t plug holes. It created strategic breathing room. The portfolio’s ability to survive further downside now rests on its ability to act. Liquidity isn’t idle capital. It’s a stored decision.

Discipline held, but structure cracked. February proved that yield without resilience is a liability. The engine runs. But now, it needs armor.

Month 5 Objectives

- Protect Capital.

No new equity purchases unless cash buffer remains above 12% NAV post-trade. Position trims will be triggered if total return remains negative after next distribution. - Income Target: $400

Target remains unchanged. However:- Options must exceed 2.50% entry yield

- Early exits only allowed if >75% premium is captured with <50% time remaining

- Income mix target: ≥70% from core CSPs, ≤30% from tactical outliers

- Reduce CONY Exposure

CONY faces automatic trim if March NAV fails to hold above $10 post-dividend.

Reallocation will favor MSTY only if BTC correlation reasserts. - Preserve Liquidity

Maintain minimum $2,000 cash buffer at all times.

Any CSP assignment must be pre-approved by cash reserve thresholds.

March is not for expansion. It’s for fortification. The portfolio can still compound,but only if each trade earns its place.

Final Thoughts

February was not the storm. It was the undertow.

The portfolio didn’t crash, it cracked. NAV fell. Structure leaked. And income, while impressive, couldn’t mask the fragility underneath. That’s the reality of yield-based strategies in low-volatility markets: the pain isn’t loud, it’s cumulative.

But this month also marked a pivot. Liquidity was restored. Execution tightened. And the first real total return audit surfaced what needs fixing.

The lesson isn’t to chase. It’s to refine. In March, every trade must earn its risk. Every dollar must prove its place. That’s the mandate now: not growth for its own sake, but growth that survives itself..

Follow the Yield

If this breakdown challenged your thinking or sharpened your edge, follow along for the next chapter.

- Is your portfolio structured to survive multiple losing months without needing a deposit?

- Are you measuring return by what you’re paid, or by what you’re left with?

- Which of your positions would you still own if they stopped paying for 60 days?

Stay connected. Watch how this strategy evolves. And if you are building yield too, share your progress.

The markets won’t wait. Neither should your strategy.

Leave a comment