Foreword

January moved like a low tide, pulling back the market’s bravado and revealing bare conviction. Prices slipped, Red ink bled, and Volatility sank, exposing portfolios to quiet pressure. But even in its sharpest unrealized loss yet, the truth held: Income never wavered.

It took hits, It stood. It held the line. Not by timing markets, but by trusting in yield. No glamour just grit.

Month 4 Objective Review

- Deploy $3,000 across core ETFs

- $2,459.64 deployed (~82% of Target)

- Income target of $400 in dividends and option premiums

- $405.71 earned (~101% of Target)

- Maintain 10 – 12 % of portfolio in cash for assignments, and dip buys.

- $92.57 cash at month end (~0.5%)

The ETF buys came in below target, which (in hindsight) helped preserve some cash at a time when liquidity proved critical.

Income met its goal, but the cash buffer closed dangerously thin. With only 0.5% in reserve, February begins with limited room to maneuver until the next deposit.

The next move isn’t more exposure. It’s about rebuilding control.

Deposits

- Total Cash Deposit – $3,119.52

This injection anchored January’s capital deployment. While most of it funded MSTY and CSPX allocations, it also helped sustain the portfolio’s momentum without risking forced liquidations. Moving forward, deposit pacing will need to align more tightly with buffer preservation and not just equity growth. The margin for error narrows, when the well runs dry.

Market Update

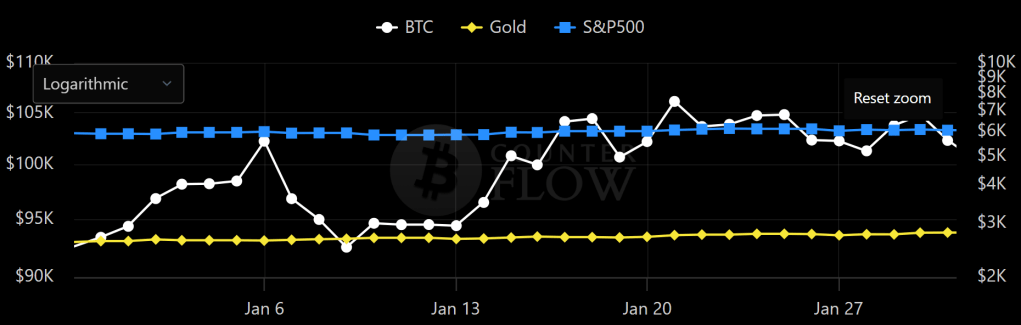

- The S&P 500 rose 2.33% supported by mega-cap tech and broad market strength.

- Federal Reserve held rates at 4.25 – 4.50% maintaining a cautious, data dependent stance in Jan 2025

- BTC closed at $102,405 up 9.6% but with fading momentum..

- The CBOE Volatility Index ended at 16.43 reflecting moderate calm but not record lows.

- Implied volatility remained muted across most ETFs, limiting option premium potential.

- Market breadth improved, though large cap led gains disproportionately.

Why This Matters:

Despite the strength in risk assets, premiums stayed weak. Volatility dropped, leaving little edge in option selling across the core income ETFs. MSTY trailed BTC, weighed down by low MSTR correlation and compressed IV. With no trades worth writing, dividends did all the heavy lifting. January proved that doing less is more.

While BTC surged behind the scenes, silence ruled the room.

As S&P and Gold slept, volatility slipped out the back.

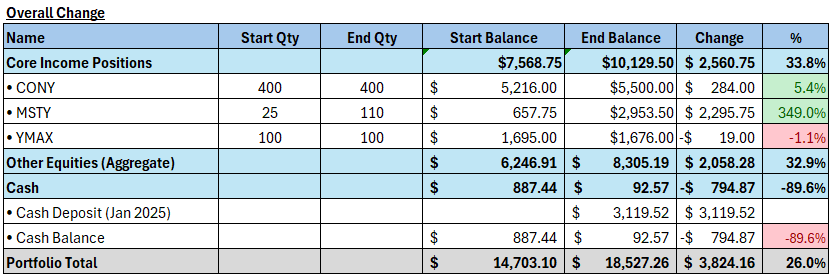

Portfolio Snapshot (31 Jan 2025)

The portfolio ended January 2025 at $18,527.26 marking a strong +26% month-on-month gain. The surge was powered by a decisive MSTY accumulation, modest equity recovery and robust dividend footing.

But beneath the surface, price action whispered a different story..

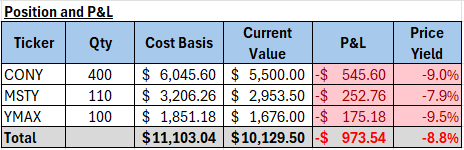

- All 3 ETFs (CONY, MSTY, YMAX) closed in the red on a price basis.

- Unrealized losses totaling – $973.54, even as nominal value climbed.

- Total income reached $405.71, anchoring performance through yield.

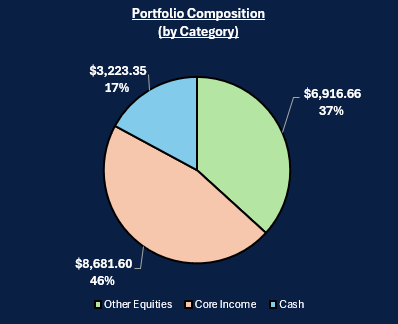

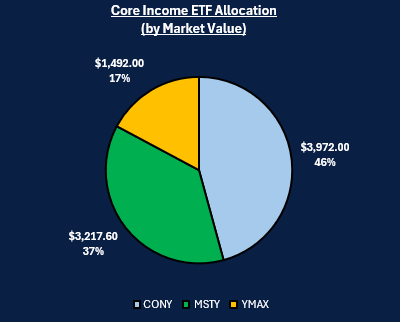

Breakdown by Allocation:

- CONY: 54%, Top dividend earner. Workhorse of the core.

- MSTY: 29%, Capital deployed aggressively. Driver of growth, yet vulnerable to BTC lag.

- YMAX at 17%, Stable, but weakest performer in both price and yield.

Cash balance scraped in at $92.57, with no room for CSP assignments and zero margin for sudden dips. Rebuilding liquidity is now the first order of business.

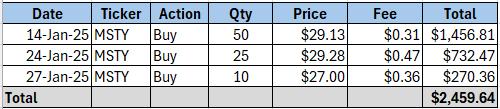

Key Transactions

January focused on targeted capital deployment with a strategic push into MSTY completing the core income build. Three tranches of 50, 25 and 10 shares were added at an average cost of $28.94, bringing the total position to 110 shares. This solidified MSTY’s role as the portfolio’s crypto-linked yield play. The purchase was timed during a period of low volatility and subdued sentiment in BTC.

In parallel, $1874.81 was allocated to 3 units of CSPX, a globally diversified S&P 500 ETF. While non-yielding, CSPX adds a growth oriented counterweight to the income heavy portfolio.

No options were written during the month. Low volatility across all 3 Core income ETFs offered limited premium opportunities. The focus remained on equity allocations completion.

Core Income Position Total Return Analysis

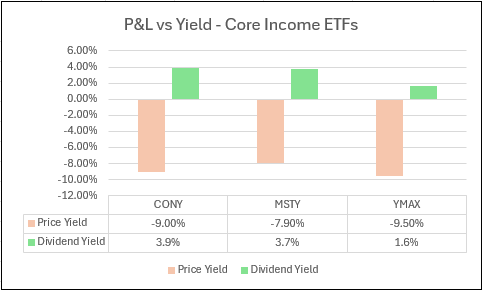

While January closed green in nominal terms, the mark-to-market (MTM) told the real story. All three income ETFs finished below cost, with unrealized losses totaling -$973.54. A visual sting, the cost of early aggressive accumulation.

Still, income didn’t flinch. Dividends across CONY, MSTY and YMAX delivered $405.71, hitting the Month 4 income goal.

Why This Matters:

In low IV, yield becomes the anchor. No CSPs written, nor CCs filled. Premiums were absent, yet cash still came in. Passive, Persistent, Protective. This is why we built core.

Lessons Learned

January’s red close wasn’t just numbers. It was a reminder that prices fall, sentiments sour, but if the structure is sound, income still flows.

- Aggression without reserves invites fragility.

MSTY’s rapid scaling burned through cash. Without a buffer, the portfolio became rigid, unable to pivot or defend. - Yield shields, but doesn’t insulate.

Dividends held the line, but couldn’t reverse the mark-to-market losses. Yield is ballast, not armor. - Low IV punishes the impatient.

With premiums thin, forced trades become costly. Waiting instead, becomes the most profitable strategy.

The portfolio survived the test, albeit roughed up a little. February’s priority is not more buying, but about regaining flexibility and restoring reserves. Only then can we press forward.

Month 5 Objectives

- Rebuild Liquidity

No new equity buys unless buffer exceeds 10% of portfolio. Cash is the oxygen of options and January nearly choked it dry. Top priority is rebuilding flexibility. - Selective Option Selling

Target CSPs on MSTY only if IV rises and premium exceeds 2% return on collateral. No forced trades. Wait for the setup. - Monitor BTC – MSTR Divergence

MSTY’s decoupling from BTC weakens its short term thesis. A sharp BTC rally without MSTR follow through is a red flag. Trim if divergence worsens. - Income Target $400

Same goal. Let current positions work the yield engine.

Final Thoughts

January was a stress test, and the system held. Not without a few bruises, but without breaking.

The month reminded us that momentum can mask fragility, and liquidity is a lifeline, not a luxury.

Even as premiums dried and prices slipped, income endured. That resilience wasn’t luck. It was by design.

February isn’t about reaching further. It’s about resetting the base. Restoring cash, refining focus, and waiting for volatility to return. The core stays intact. The mission stays unchanged.

Yield leads. Patience pays. Let’s move forward, but only when the ground is firm.

Take the Next Step

If this breakdown helped sharpen your thinking, consider doing the same for your own portfolio.

- Review your income positions. Are they working as intended?

- Check your liquidity. Do you have a buffer, or are you over-extended?

- Track your income. Yield isn’t passive if you’re not measuring it.

Stay connected. Watch how this strategy evolves. And if you are building yield too, share your progress.

This journey isn’t about chasing gains. it’s about building staying power. Let’s keep going – wisely.

Leave a comment