Foreword

November proved a pivotal month as two forces converged. The Federal Reserves 25bp rate cut lifted NAVs across our Income ETFs, while Bitcoin’s 37% surge reignited crypto-linked volatility premiums. By maintaining a lean cash buffer, we executed a dividend capture on CONY, driving a robust 24.6% NAV increase and unlocking option income opportunities.

Month 2 Objective Review

- Deploy $1,500 into CONY for $100 / month in dividends (~6%)

- $625.31 deployed (~42% of Target)

- Net Dividend $84.97 (~85% of Target)

- High capture efficiency, but under-deployment of capital.

- Maintain a cash buffer to manage option assignments and buy on dips

- $1,020.92 in cash at month end (~10.8% of portfolio)

Deposits

- Total Cash Deposit – $1209.01

Market Update

- The S&P 500 gained 5.7% in Nov 2024, the strongest month of 2024. Consumer discretionary stocks which include companies like Amazon and Tesla recorded the highest gains at 13.2%.

- Federal Reserve cut interest rates by 25 basis points (25bp) which signaled a data driven easing path ahead.

- BTC closed at $96,449 up 37.4% for the month as crypto markets regain momentum.

- The CBOE Volatility Index fell to 13.51 down from October’s post-election spike.

- US election outcomes drove a late month relief rally, easing volatility across the board.

These moves set up an ideal environment for income-focused strategies. Equity rallies and rate cuts lifted ETF NAVs, bolstering unrealized gains. The Bitcoin surge, in particular, enhanced the appeal of crypto-linked funds, offering richer premium opportunities. In the meantime, Federal reserve easing supported dividend sensitive ETFs.

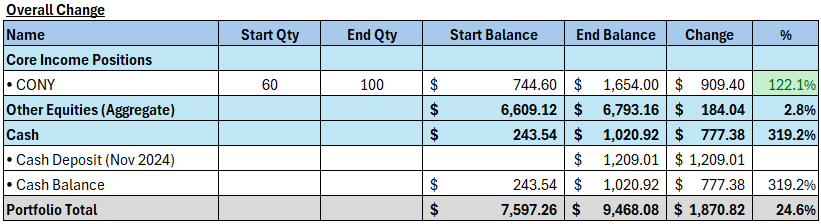

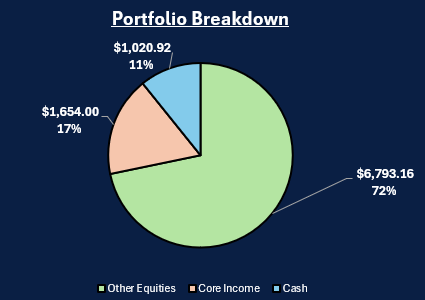

Portfolio Snapshot (30 Nov 2024)

Excluding the new deposits, the portfolio grew from $7,597.26 to $8,259.07 (+8.7%) in November driven by the addition of CONY shares and a modest gain in my other equities. When including the $1,209.01 of fresh capital, the total rose to $9,468.08.

Key Transactions

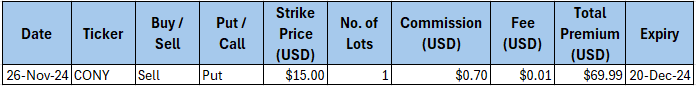

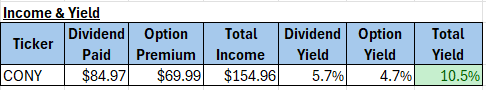

In November, all active trading was focused on CONY, with a two step dividend capture. By buying ahead of the ex-dividend date and selling into the pop, we realized approximately $351.26 of pure capital gain on 100 shares, plus $84.97 in net dividends for combined total of $436.23 of income on just $600.33 of new deployment. This translates to a ROI of 73% on fresh capital after fees. We immediately redeployed proceeds to maintain our 100 share core stake.

A cash secured put on CONY added $69.99 of premium and a covered call on TIGR (Captured under Other Equities) added $30.85 of premium, underscoring that while satellite trades can bolster returns, our core ETF strategies drive the bulk of income generation.

Lessons Learned

- Balance deployment and buffer: Adjusted to reduce sidelined capital (~12% Cash Buffer)

- Under-deployed capital: Funding only 42% of our CONY target left yield on the table. To scale allocations next month to meet income goals.

- High dividend capture efficiency: A 73% ROI on $600 capital investment shows that precision trades can dramatically amplify income,

Core Income Position Total Return Analysis

Our November performance has shown that precision in core income strategies drives the bulk of the yield. By focusing on CONY dividend captures and maintaining a disciplined cash buffer, we achieved a 73% ROI on fresh capital and locked in a significant NAV gain across the portfolio. As we head into December, we will scale those core positions, and continue to optimize for cash-on-cash returns.

Month 3 Objectives

- Deploy $7,000 across core ETFs

- Income target of $200 in dividends and option premiums

- Maintain 10 – 12 % of portfolio in cash for assignments, and tactical dip buys.

What dividend capture or option strategy have you found most effective? Share your insights or questions in the comments below.

Leave a comment