Foreword

In October 2024, I deposited another $378 to add to my starting capital. I then deployed 60% into CONY to kick-start income generation. This post shows my initial core allocation, lessons learnt, and the plan for November.

Objectives for November

- Deploy $1,500 into monthly paying High Yield Income Funds (CONY) to generate $100 / month in dividends (~6%)

- Maintain a cash buffer to manage option assignments and buy on dips

Market Update

- The S&P 500 fell 0.9% in Oct 2024, reversing a modest rally as tech and growth stocks sold off late in the month and seasonal weakness set in.

- October’s Federal Reserve minutes showed a substantial majority of officials supported September’s half-point rate cut, but declined to commit to a pace or timing of future moves.

- BTC closed at $70,215.19 on Oct 31, up 10.9% for the month due to renewed retail interest.

- The CBOE Volatility Index climbed 23.16 as traders hedged against year-end risks.

Together, these developments underscore a complex backdrop for income‐focused investors. The late-month S&P pullback and higher VIX signal elevated equity volatility, which can widen option premiums but also pressure NAVs. The Federal Reserves “patient” stance on further rate moves supports yield-sensitive ETF, yet without a clear cut path, income assets may see choppy trading. Meanwhile, Bitcoin’s 10.9% rally decouples crypto from equities, highlighting that CONY (with crypto‐exchange exposure) requires monitoring of both equity and crypto markets when sizing positions or hedging.

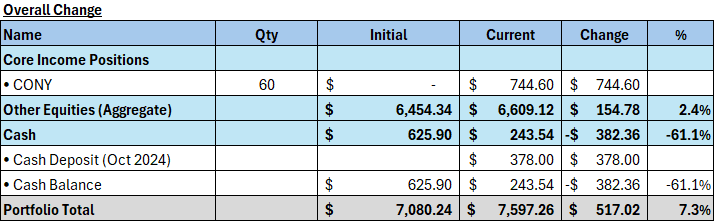

Portfolio Snapshot (31 Oct 2024)

Excluding the new deposits, the portfolio grew from $7,080.24 to $7,219.26 (+2.0%) in October driven by the addition of CONY shares and a modest gain in my other equities. When including the $378 of fresh capital, the total rose to $7,597.26.

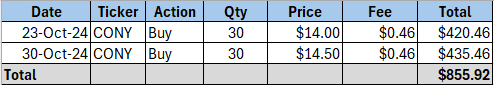

Key Transactions

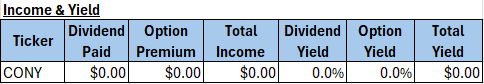

In late October, i added 60 shares of CONY in 2 tranches targetting a 7% yield, not expecting the later $12.41 low. These purchases increased my CONY position, boosting my expected monthly dividend income by $66 (Pre-Withholding tax), while still leaving room in the cash buffer for more purchases.

Lessons Learned

- Balance deployment and buffer: A 60 / 40 split between invested capital and cash ensures both growth and flexibility

- Staggered Buys Matter: While averaging into CONY at $14 to $14.50 helped smooth out cost basis, the month-end dip to $12.41 (-11.6% of our first tranche) underscores the important of breaking large purchases into smaller, evenly spaced entries to avoid overexposure at high prices.

- Distribution Irrelevance to Total Return: A high distribution rate can mask underlying NAV decline. Focus on Total Returns (NAV change + distributions) rather than just the yield percentage. Otherwise, you might end up with negative real growth despite large periodic payouts.

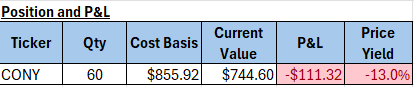

Core Income Position Total Return Analysis

CONY’s NAV is down 13% to $12.41. With no dividends or premium yet collected, this results in a -13% total return to date.

Given CONY’s crypto link, which hedging strategies would you use on a similar fund?

Leave a comment