Foreword:

I began actively growing this US Equity-Income portfolio in October 2024 with just a few thousand dollars. I had a simple plan: To build a reliable stream of dividends and option premiums. My goal was also to chase capital growth. 25 weeks later, I am sharing every position, every trade, and every lesson I have learned. This lets you follow along and see how small consistent action can compound into meaningful income.

In this post, you will see my starting cash allocation. You will also see my initial objectives. I will outline the exact steps I will take in October to kick-start generation.

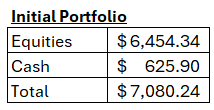

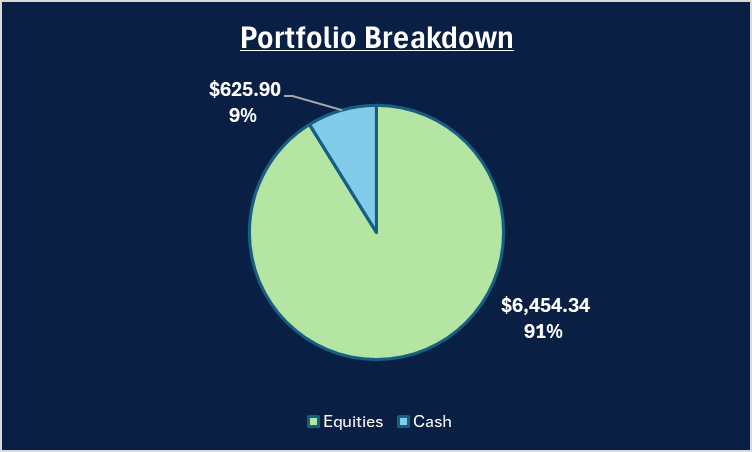

Starting Capital and Objectives

I experimented with various meme stocks in late 2024. I’ve refocused this series on high-yield dividend ETFs, and covered-call/put strategies. The equities listed below consists of those early, non-core trades.

Objectives for Month 1 (Oct 2024)

- Deploy 60% Cash Balance into monthly paying High Yield Income Funds (CONY) to generate $100 / month in dividends (~6%), while maintaining a 40% Cash buffer.

- Maintain a cash buffer to manage option assignments and buy on dips

- Introduce option overlays with covered calls once positions are established.

- Track performance of dividends, options premiums and unrealized P&L.

Next Steps

- ✅ Buy Initial positions

- 🖊 ️Record transactions

- 🔄 Review cash buffer and evaluate portfolio

Leave a comment